Ted1858

·Hi all,

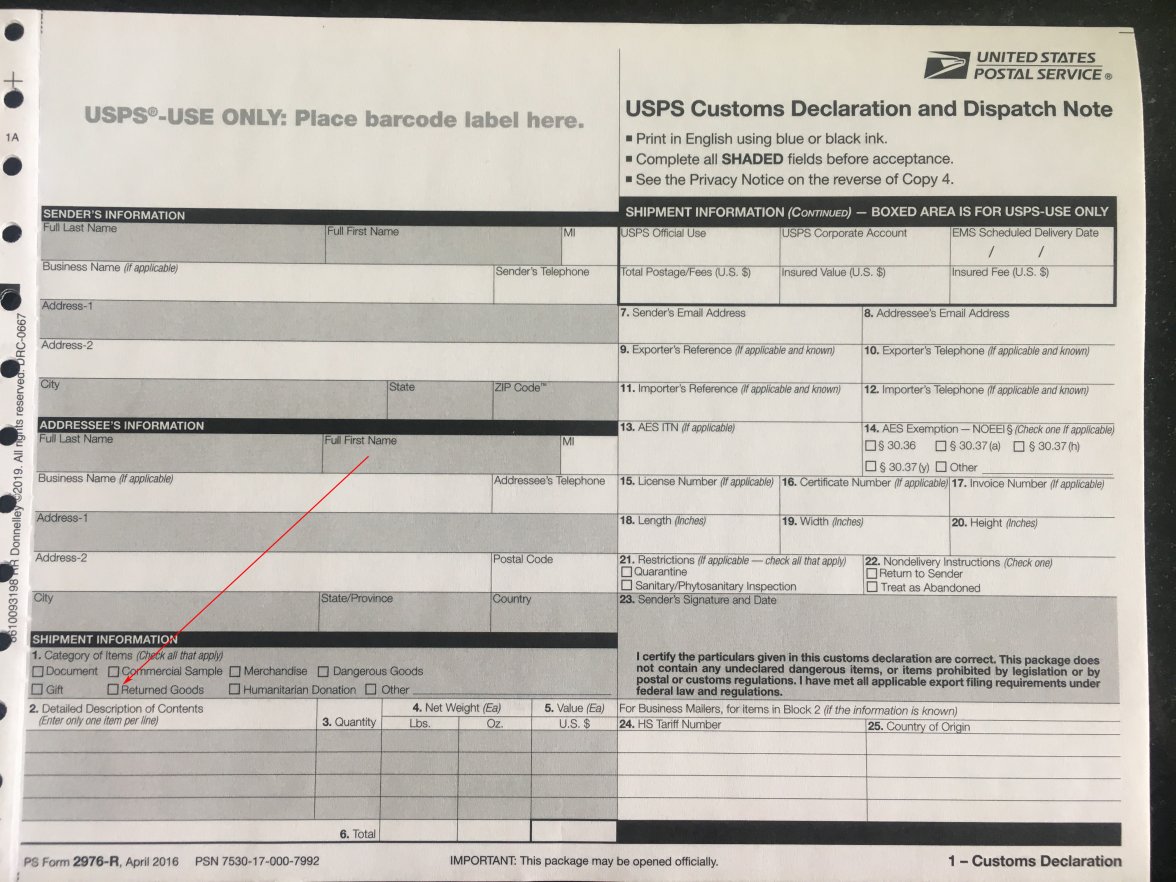

I purchased a watch from the EU that was shipped here to the US. Now, I am trying to send it back to the seller. How does VAT apply when returning something? Is it treated the same as any other import?

Thanks!

I purchased a watch from the EU that was shipped here to the US. Now, I am trying to send it back to the seller. How does VAT apply when returning something? Is it treated the same as any other import?

Thanks!