Looking to buy a new watch as a longer term investment

Nobel Prize

·Only Omega I know the buy and hype value was the PO LMLE which still today carries more value than a new one. rolex Daytona would be another example but the new ones will keep their value more than gain I think. That's it for the mid luxury brands before you go to the real big boys of luxury like PP, Vaucheron etc.

If you buy a good vintage piece or source a good second hand then you have more of a chance.

The snoopy could or could not be a good choice, research how the previous Snoopy performed and you'll get an idea of the investment value you're facing.

If you buy a good vintage piece or source a good second hand then you have more of a chance.

The snoopy could or could not be a good choice, research how the previous Snoopy performed and you'll get an idea of the investment value you're facing.

E-diddy

·Buy a new watch 60 years ago, keep everything from the purchase, store it in a climate controlled environment.

Oh, hang on, I forgot to mention, buy a time machine first.

As Dennis said, start with a fortune....................

Know of any time machines that do not require a hot tub?

ikeo1

·Not sure a watch as an investment is a great idea. As with any collectible, the market determines what is collectible. Some will hold their value better than others, but the appreciation rate is pretty slow for the gainers.

I think sticking with stocks/R.E. or whatever else is definitely better unless you want to preserve some capital. Keep in mind, even when you want to sell your "investment" you must find a buyer which takes some time as well...

I think sticking with stocks/R.E. or whatever else is definitely better unless you want to preserve some capital. Keep in mind, even when you want to sell your "investment" you must find a buyer which takes some time as well...

Raffles

·Only Omega I know the buy and hype value was the PO LMLE which still today carries more value than a new one. rolex Daytona would be another example but the new ones will keep their value more than gain I think. That's it for the mid luxury brands before you go to the real big boys of luxury like PP, Vaucheron etc.

If you buy a good vintage piece or source a good second hand then you have more of a chance.

The snoopy could or could not be a good choice, research how the previous Snoopy performed and you'll get an idea of the investment value you're facing.

dsio

··Ash @ ΩFDo they just stop along the road..."Honey pull over I think that's a double rolled three pronged fence with a beautiful patina!"🙄

flyingout

·Curiouser and curiouser.

http://www.collectorsweekly.com/art...wboy-scourge-to-prized-relic-of-the-old-west/

Of all the aspects of barbed-wire collecting, this is probably the one that’s most curious to people who pursue things like Art Deco radios and Fenton glass. “The Symposium sets all the value on wires,” says Hagemeier. “There is a special committee of about 10 to 12 men who review the value of not only wire but tools and other things. They set the prices for a year.”

I think we have a solution!

http://www.collectorsweekly.com/art...wboy-scourge-to-prized-relic-of-the-old-west/

Of all the aspects of barbed-wire collecting, this is probably the one that’s most curious to people who pursue things like Art Deco radios and Fenton glass. “The Symposium sets all the value on wires,” says Hagemeier. “There is a special committee of about 10 to 12 men who review the value of not only wire but tools and other things. They set the prices for a year.”

I think we have a solution!

ikeo1

·Thank you. Think I have opened a big debate. Can you really but an omega as an investment? I suspect letting it go would be bitter sweet.

It's quite bitter sweet indeed, but sometimes you have to do what you got to do.. Priorities! These aren't cheap watches and they could fund so many other things.

STANDY

··schizophrenic pizza orderer and watch collectorStubby coolers are the biggest collectible in Darwin 🤦🤦🤦 some worth big money.

Traveler

·Assuming barbed wire is not your thing, and you absolutely have to 'speculate' on watches, just buy a watch you like (it would help if it's a 321 Speedy) and stick some money in this ;

http://www.eliteadvisers.com/themes/collectible-watches

Or not...

http://www.eliteadvisers.com/themes/collectible-watches

Or not...

ffej4

·Hi all. My first post. I am looking at buying a new watch but want one that may go up in value over time. Was thinking of the upcoming Speedmaster Apollo 13 Silver Snoopy award? Guessing will be very hard to source? Will it be a good buy?

I'm sure this has already been mentioned, but if you're looking to both wear it AND treat it as an investment, I always suggest buying used.

Reason being is that when you purchase new, any watch (unless it is extremely limited) will experience tremendous depreciation in the first few years. For example, if I buy a new Planet Ocean for $6,500, then the moment I remove/throw away the tags and get a couple of small scratches on it, it will have dropped in value a substantial amount, say, $500 or more. Personally, those first few scratches and the joy of removing the plastic are not worth the extra money.

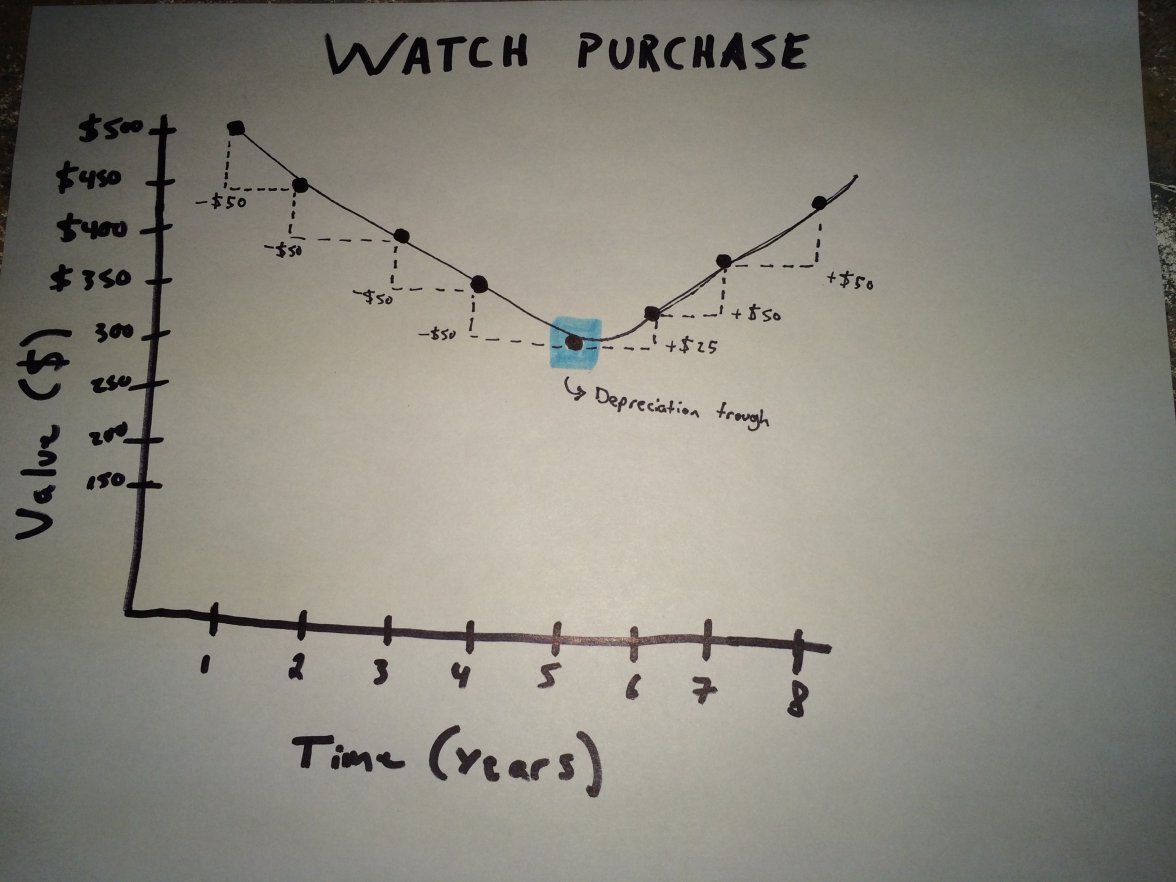

I've created a graph (albeit a crappy one drawn by hand) that shows depreciation vs. appreciation for a watch purchase. Nearly any watch will undergo significant depreciation when purchased new, and then the amount of the depreciation will gradually slow, year by year, until the watch begins to gain value. It is at the "trough" - or the lowest point of depreciation - that you should aim to purchase a watch as an investment. Essentially, you want appreciation to begin to take effect as soon as possible from the point of investment.

Please note: this is a very general depiction of what I hypothesize most normal watches undergo in terms of depreciation and appreciation, given that the watch will indeed appreciate at some point. Some watches will never appreciate (unfortunately). It's nothing too scientific! If anyone sees a major flaw, please let me know.

Edited:

Nobel Prize

·Yes, I think the graph is out by a good margin. Most any watch will loose 20 to 25% off the bat, that is the soft part of the retail mark up based on franchise fees etc, which is why it is also the normal margin of discount for gray dealers (who don't pay those fees and hence are not "authorized" nor can they offer the "brand warranty", That is the only real difference between AD and REPUTABLE gray dealers who incidentally get their watches from the same boutiques and sources, which is why it is sometimes a little funny to see how much nonsense some buyers have regarding buying "AD ONLY" when some dealers actually meet and surpass the warranty standards. That is also the margin of discount that the AD's and Boutiques will fluctuate to as a max discount for the same reason. With some exceptions that 20 to 25% is lost immediately, It is also the first bracket I would recommend someone buying to look for, specially if thinking of flipping, because after that bracket the value ,depending on the watch, is more stable.

On your graph you have a 10% depreciation on year one, and another 10% at year 2's end...in reality that 20% is lost within days, with typically 10 to 15% of that the moment you remove a tag (hence the restocking fee value bracket on returns)

You then continue into a 40% loss into year 4 (you don't seem to have a loss at year 5 but maybe you're measuring at start of year instead of end of year, in which case year 0 to 1 is completely neglected, which has the highest % of loss in the real world)

40 to 50% depreciation in 5 years may not be far from target, but I would venture a watch that lost 50% value in 5 years is not likely at all to gain 25% back on year 6, why? because stores carry these lines for years, so if I want an smp300cx and I can get one 5 years old for 50% price, but a 6 year old for 75% price then I may as well just get a 2 year old for a 20%-30% discount. I get a newer model for less money and if I have a 5 year old I should not sell because in a year it is worth a lot more. Also an Older model is found on stores for about 2 years of inception.

In other words, there is no general chart or rule that can really map the value of a watch, or else the market would be too predictable and not competitive or emotional enough to serve a purpose. I have a Panerai Radiomir California with date. I bought it the moment Panerai decided that after only one year of their already limited editions they would not have that model with date and go back to blue hands instead of gold. That watch gained in value before it hit my safe as you can only buy one series of that item with date. same with the LMLE. the Daytona is a weird example where people will pay more for a second hand one just so they don't have to wait for a new one (not so much anymore but it still keeps value) so, If the watch you're buying is desirable but discontinued (like a rolex 5512 versus a 5513 in 1980) then your chart falls short. If your watch is from a line that is current and not discontinued then your chart is optimistic. If it is a historic watch like a speedy 321 or pre moon then it falls short. If it is a modern speedy even a hesalite one again it is optimistic. In fact I am not sure what cases it may cover...maybe snoopy editions, DSOM, GSOM, WSOM etc that may have limited editions that make them desirable once you can no longer find them in any store...which may be around year 3 or 4

On your graph you have a 10% depreciation on year one, and another 10% at year 2's end...in reality that 20% is lost within days, with typically 10 to 15% of that the moment you remove a tag (hence the restocking fee value bracket on returns)

You then continue into a 40% loss into year 4 (you don't seem to have a loss at year 5 but maybe you're measuring at start of year instead of end of year, in which case year 0 to 1 is completely neglected, which has the highest % of loss in the real world)

40 to 50% depreciation in 5 years may not be far from target, but I would venture a watch that lost 50% value in 5 years is not likely at all to gain 25% back on year 6, why? because stores carry these lines for years, so if I want an smp300cx and I can get one 5 years old for 50% price, but a 6 year old for 75% price then I may as well just get a 2 year old for a 20%-30% discount. I get a newer model for less money and if I have a 5 year old I should not sell because in a year it is worth a lot more. Also an Older model is found on stores for about 2 years of inception.

In other words, there is no general chart or rule that can really map the value of a watch, or else the market would be too predictable and not competitive or emotional enough to serve a purpose. I have a Panerai Radiomir California with date. I bought it the moment Panerai decided that after only one year of their already limited editions they would not have that model with date and go back to blue hands instead of gold. That watch gained in value before it hit my safe as you can only buy one series of that item with date. same with the LMLE. the Daytona is a weird example where people will pay more for a second hand one just so they don't have to wait for a new one (not so much anymore but it still keeps value) so, If the watch you're buying is desirable but discontinued (like a rolex 5512 versus a 5513 in 1980) then your chart falls short. If your watch is from a line that is current and not discontinued then your chart is optimistic. If it is a historic watch like a speedy 321 or pre moon then it falls short. If it is a modern speedy even a hesalite one again it is optimistic. In fact I am not sure what cases it may cover...maybe snoopy editions, DSOM, GSOM, WSOM etc that may have limited editions that make them desirable once you can no longer find them in any store...which may be around year 3 or 4

Edited:

ffej4

·Well, you showed me! Haha. I just wanted to create a very general graph that (I thought) most watches tend to follow, granted they actually begin to appreciate eventually.

Like you said, there are plenty of exemptions, like the LMLE and the Daytona.

My graph really wasn't supposed to be accurate, but rather display a general down-then-up display of the value of a piece. Though, I really don't know what I'm talking about it, so it was more of a hypothesis than anything else. [emoji1]

Like you said, there are plenty of exemptions, like the LMLE and the Daytona.

My graph really wasn't supposed to be accurate, but rather display a general down-then-up display of the value of a piece. Though, I really don't know what I'm talking about it, so it was more of a hypothesis than anything else. [emoji1]

Raffles

·I'm sure this has already been mentioned, but if you're looking to both wear it AND treat it as an investment, I always suggest buying used.

Reason being is that when you purchase new, any watch (unless it is extremely limited) will experience tremendous depreciation in the first few years. For example, if I buy a new Planet Ocean for $6,500, then the moment I remove/throw away the tags and get a couple of small scratches on it, it will have dropped in value a substantial amount, say, $500 or more. Personally, those first few scratches and the joy of removing the plastic are not worth the extra money.

I've created a graph (albeit a crappy one drawn by hand) that shows depreciation vs. appreciation for a watch purchase. Nearly any watch will undergo significant depreciation when purchased new, and then the amount of the depreciation will gradually slow, year by year, until the watch begins to gain value. It is at the "trough" - or the lowest point of depreciation - that you should aim to purchase a watch as an investment. Essentially, you want appreciation to begin to take effect as soon as possible from the point of investment.

Again, this is a very general graph. It's nothing too scientific! If anyone sees a major flaw, please let me know.

CajunTiger

·I'm sure this has already been mentioned, but if you're looking to both wear it AND treat it as an investment, I always suggest buying used.

Reason being is that when you purchase new, any watch (unless it is extremely limited) will experience tremendous depreciation in the first few years. For example, if I buy a new Planet Ocean for $6,500, then the moment I remove/throw away the tags and get a couple of small scratches on it, it will have dropped in value a substantial amount, say, $500 or more. Personally, those first few scratches and the joy of removing the plastic are not worth the extra money.

I've created a graph (albeit a crappy one drawn by hand) that shows depreciation vs. appreciation for a watch purchase. Nearly any watch will undergo significant depreciation when purchased new, and then the amount of the depreciation will gradually slow, year by year, until the watch begins to gain value. It is at the "trough" - or the lowest point of depreciation - that you should aim to purchase a watch as an investment. Essentially, you want appreciation to begin to take effect as soon as possible from the point of investment.

Again, this is a very general graph. It's nothing too scientific! If anyone sees a major flaw, please let me know.

I have a bunch of watches Id like to sell you.

Nobel Prize

·Well, you showed me! Haha. I just wanted to create a very general graph that (I thought) most watches tend to follow, granted they actually begin to appreciate eventually.

Like you said, there are plenty of exemptions, like the LMLE and the Daytona.

My graph really wasn't supposed to be accurate, but rather display a general down-then-up display of the value of a piece. Though, I really don't know what I'm talking about it, so it was more of a hypothesis than anything else. [emoji1]

Ah, it's the businessman in me, if a graph is not meant to be accurate then it is not meant to be a graph. Sorry for being a little pedantic. But you're right on that watches depreciate and appreciate sometimes, somewhere for some reason...come to think about it I should have done as Cajuntiger, kept my mouth shut and just pm'd you with a couple of "great deals" I have for you to buy for me...darn!!😀

Hijak

·I have a bunch of watches Id like to sell you.