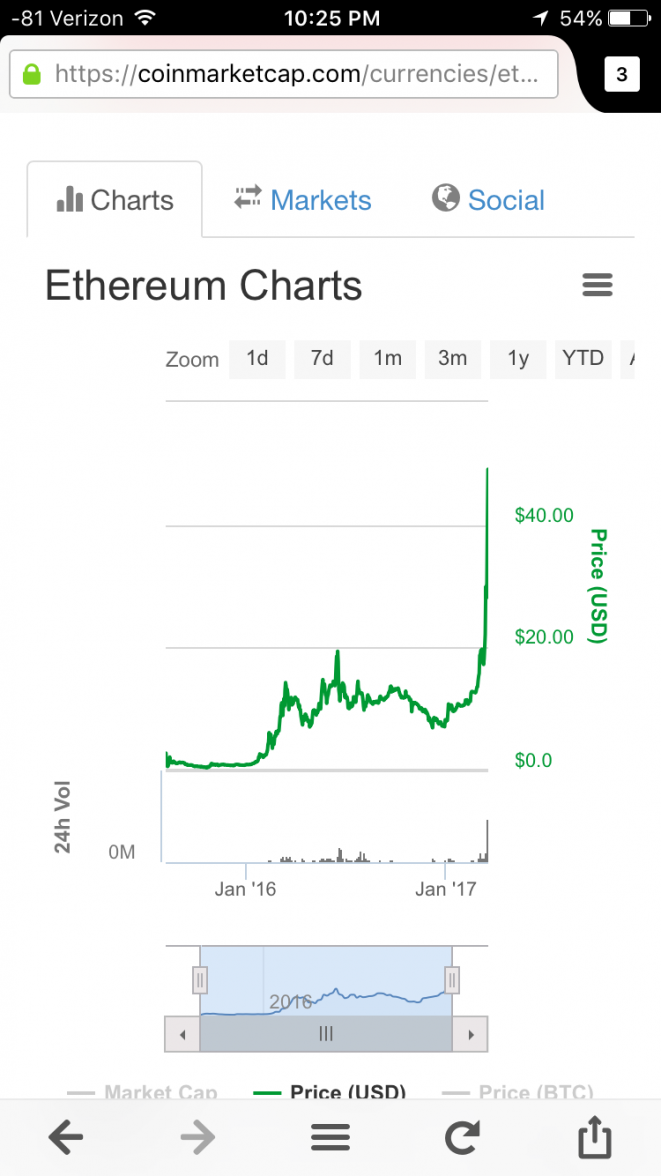

whats rising faster: ethereum or speedy prices

night0wl

·No idea but I found this searching

http://www.watchprojects.com/essays/the-speedmaster-standard/

http://www.watchprojects.com/essays/the-speedmaster-standard/

b-16707

·what an interesting read. I might as well buy speedys instead of stocks at this rate.

kidkimura

·Just following up here:

Current USD to ETH pair: $96. ETH beating speedmasters for now... but for how long.

Current USD to ETH pair: $96. ETH beating speedmasters for now... but for how long.

kidkimura

·Just Bumping this oldy. Current USD<->ETH price: $342

imajedi

·Whoa - ETH is kicking speedy @ss

harrymai86

·Ok just bought 1 Ether, hopefully next year I got myself enough fund for a 321 speedie 😗

dsio

··Ash @ ΩFI'll readily admit I'm no expert on financial markets but I've been watching BTC and ETH the last few months scratching my head wondering what on earth is going on, there's no parallel surge in gold or silver like there was last time BTC started to leap upwards enough to be on the news. I would legitimately love to know what is actually driving it right now.

Buck2466

·I'll readily admit I'm no expert on financial markets but I've been watching BTC and ETH the last few months scratching my head wondering what on earth is going on, there's no parallel surge in gold or silver like there was last time BTC started to leap upwards enough to be on the news. I would legitimately love to know what is actually driving it right now.

dsio

··Ash @ ΩFWhat scares me even more though is that there is $32Bn worth of ETH now circulating, (BTC is around $48Bn) and if banks or other large institutions are trading it, and frankly with the potential 3000% profits its hard to imagine they don't, how badly could some of them fail again if the cryptocurrency market collapses.

Drawarms

·I'll readily admit I'm no expert on financial markets but I've been watching BTC and ETH the last few months scratching my head wondering what on earth is going on, there's no parallel surge in gold or silver like there was last time BTC started to leap upwards enough to be on the news. I would legitimately love to know what is actually driving it right now.

retail consumers also are piling in in droves. In a uber pool the other day and some guy was telling us all about "Bitcoin" 🙄

dsio

··Ash @ ΩFAt least when the vintage watch market crashes I won't really care as I'll still enjoy wearing them and get to buy all the previously unobtainables... You can't exactly look at your bitcoin wallet in the elevator and smile at it :|

Foo2rama

··Nowhere near as grumpy as he used to be...Try liquidating either...

Assumed value vs what you can actually cash out with are drastically different.

Assumed value vs what you can actually cash out with are drastically different.

Kringkily

··Omega Collector / HunterYou can liquidate either in an efficient manner may not be instant as you have to go through an exchange but not all that difficult. I have a few friends who have made a lot on this digital currency but it rides up and down with the news but the one thing that worries me is that this technology isnt unique and more and more block chain currencies can pop up just a matter of user base. I still prefer the tried and true country currency that I can buy food on the street with. Atleast with Etherium they made it where you can back up your data and hopefully recover your funds if you forget your password but Bitcoin forget about it.

kidkimura

·Try liquidating either...

Assumed value vs what you can actually cash out with are drastically different.

Ethereum is perfectly liquid fwiw, up to trades in the 10s of thousands of ETH (i.e. Millions of usd). Should you be interested, coinbase (and their exchange GDax) is a US company which is both regulated and insured. I would recommend using them, but barring that there are many exchanges that can handle quite heavy volume.

keywerd

·If you think bitcoin is a wild trip then the recent moves of gbtc (bitcoin trust fund) which was trading at a ginormous premium to btc will have you pulling all your hair out.

watch3s

·or gmt prices

Similar threads

- Posts

- 27

- Views

- 4K

- Posts

- 18

- Views

- 17K