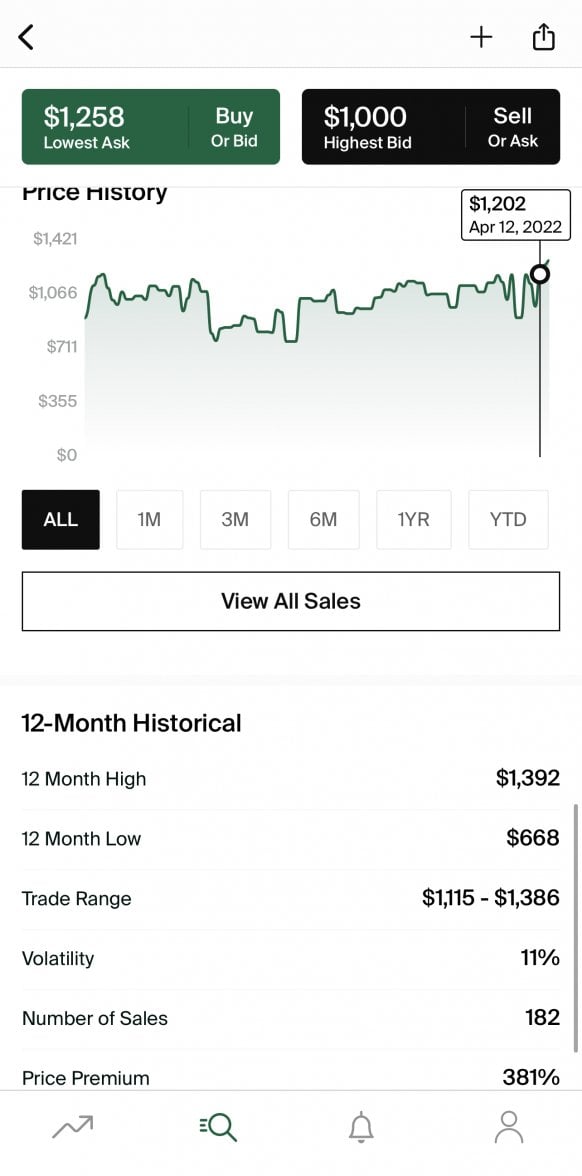

Time&Tide partnered with @watchanalytics to “

dive into how the MoonSwatch collaboration with Omega has impacted Swatch.”

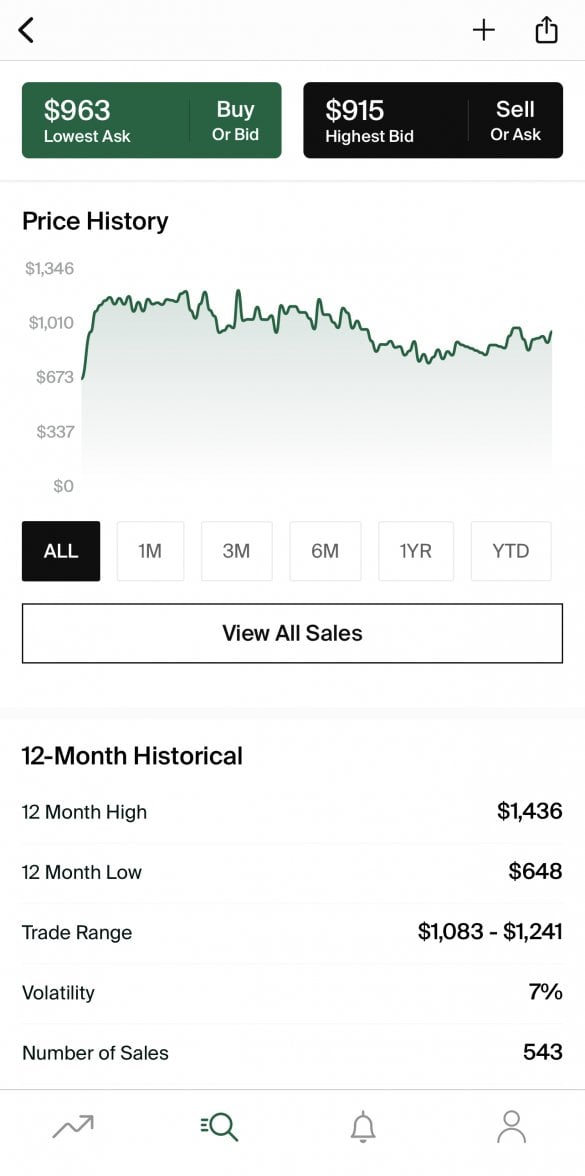

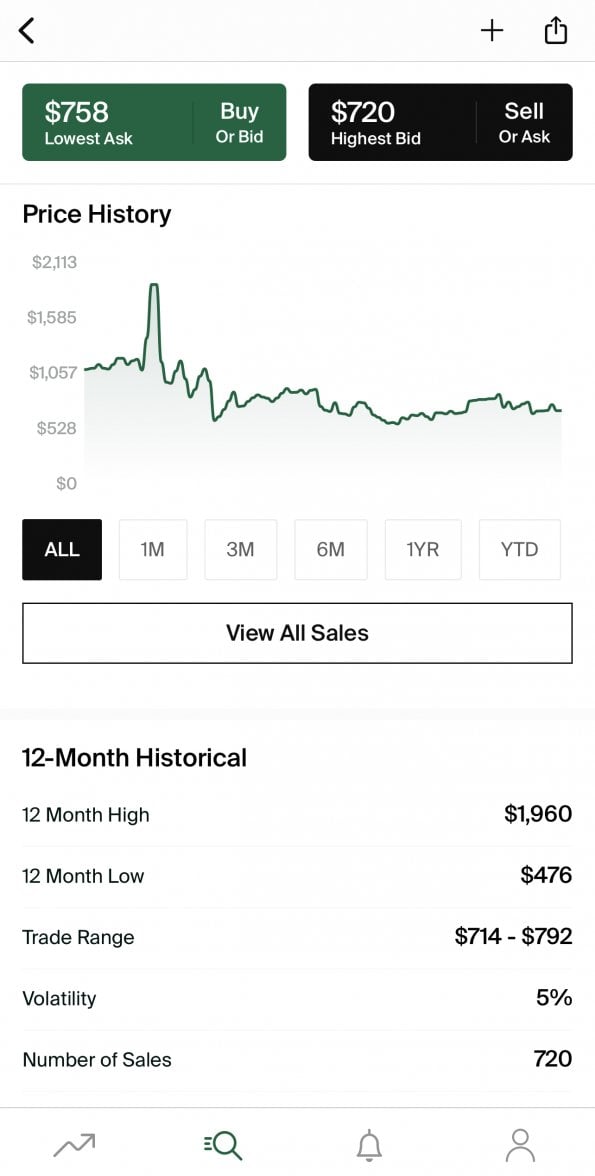

Worth going there to see the graphics and details, but:

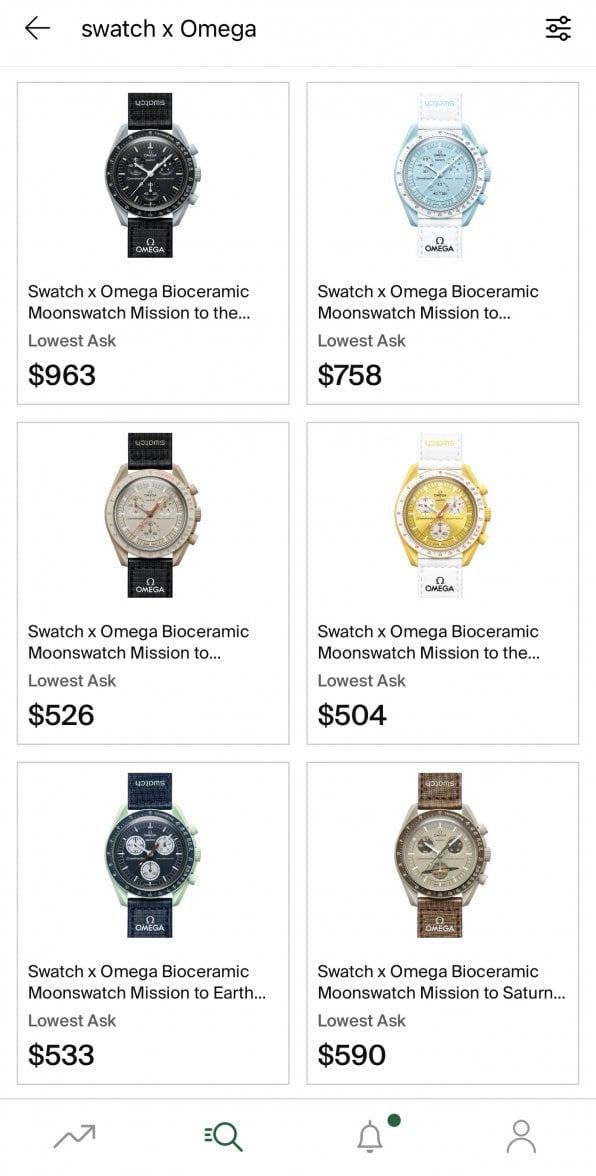

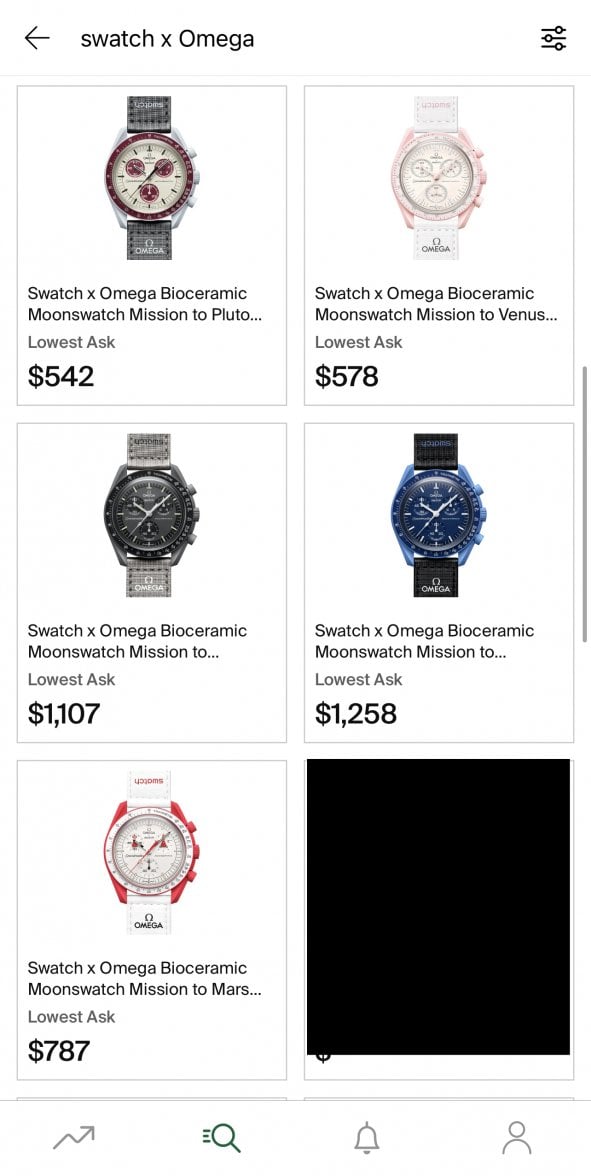

“March 26th, 2022 was a landmark day for watchmaking. No, it was not the day a new escapement was born or a new material realised. It was the day a monumental collaboration, unlike anything we have seen before, debuted for sale. And … the yield of the collaboration, and the attention and traffic it commanded, clearly displayed the potential for bringing more and more people into watch buying….

Among the 19 brands owned, Omega, Longines and Tissot represent 65% of the group’s sales while the remaining brands cover only a minority part. In particular, Swatch went from being the 18th brand in terms of sales in 2017 to 27th place in 2021, covering now only 0.6% of the market.

The MoonSwatch collaboration … opened a door that most had never been able to walk through. Sure, some may dismiss the MoonSwatch as a consented plastic knockoff or homage. For others, this was a moment to own a faithful yet fun interpretation of one of Swiss watchmaking’s most beloved icons. … It speaks to those who love Swatch, who love Omega, and especially to those who have been sidelined from luxury by fiscal constraints.”

I wish the post had gone further into more interesting analytics (there’s some analysis of the Swatch Group stock prices, but not eg internet traffic, etc.)

But more so, I’m still deeply skeptical that Swatch did this primarily focused on some “revival” of Swatch Watch in any material way intended to turn the Swatch Group numbers materially.

Ironically, the argument for why that is

not Swatch Group’s focus/intent is based on the same information @watchanalytics is using to argue the opposite conclusion:

Why think Swatch Group is focused primarily on the health of Swatch Watch when

it only represents a tiny fraction of the Group’s revenue, and is under such direct and increasing pressure from smartwatch domination?

To me, those facts just as plausible (and from my armchair more reasonably) instead suggest that Swatch Group would be at least as interested if not mostly interested in buttressing the brand that represents over 60% of the group’s revenues and is proving immune to the pressures of smartwatch competition into the future.

Not that a perk to Swatch Watch isn’t welcome, but is Swatch Group seriously maneuvering primarily to revitalize low-end quartz wristwatches. I doubt it.