bazamu

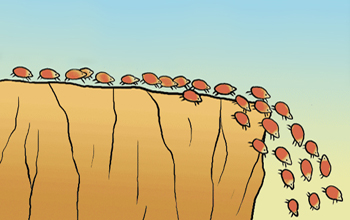

·As pointed out earlier, this topic has been discussed in-depth quarterly for the past two years. Nothing has changed. At some point, less-important examples of vintage watches will lose steam, as well as examples of rare watches that don't have matching originality or top condition. Some brands are extremely mature in terms of price (all vintage Rolex, Speedies, Patek, etc), and to jump in now requires great discipline, genuine interest (not just buying to flip), a long expected ownership. If you buy top condition at a non-outrageous price, you likely won't ever see its value crater over the long run. There are other less-heralded brands that have shot up recently (UG, Heuer, Zenith, Tudor), and it seems like some people buy anything (i.e. poor condition at a high/market price) just to not miss the boat while they continue to rise in value. Those are the people who will be hurt whenever the market moves on or if macroeconomic changes (rising interest rates, recessions, etc.) change spending habits for the majority of collectors.

Buy the best possible condition examples every time, avoid paying stratospheric prices, and in the intermediate term (5-10 years) and longer term (10+), I feel extremely confident in saying that your "investment" will be fine.

Buy the best possible condition examples every time, avoid paying stratospheric prices, and in the intermediate term (5-10 years) and longer term (10+), I feel extremely confident in saying that your "investment" will be fine.