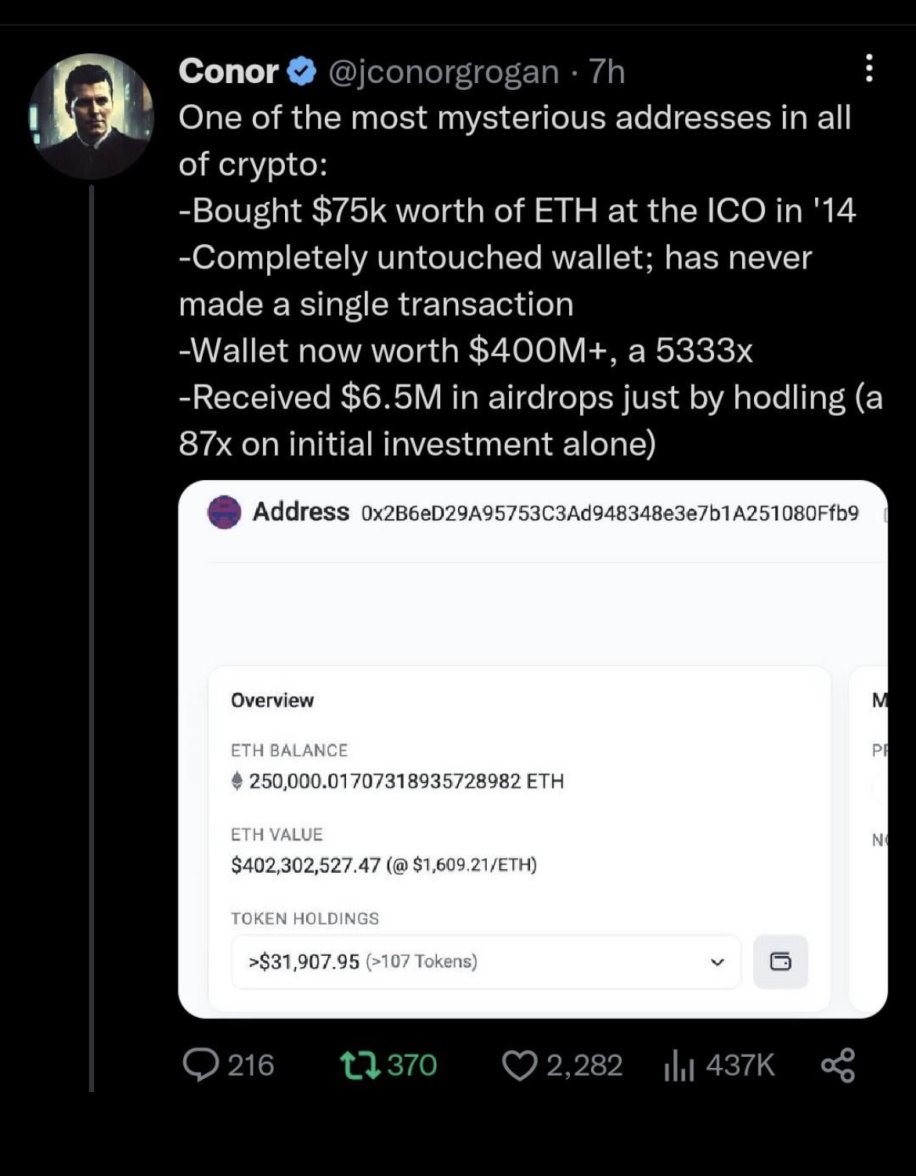

Completely agree that over the long haul being invested in the stock market will be a winner, but there have been lengthy periods where after a market decline it takes a long time to get back to that previous high. After a high in Jan 1973 it took until 1985 for investors to get their money back from US stocks in real terms. From a high in Mar 2000 it took 6.7 years to get back to that level, and from another high in Oct 2007 it took until mid-2012. A lot of people now are thinking we are in one of those markets where it all goes sideways for awhile, at least until Nov 2024 when the next election takes place. If your time horizon is long it probably makes sense to dollar-cost average into the market, those whose time frame is shorter should be cautious. I'm now 40% in cash, buying bank CDs which are now paying 5% APR, or solid stocks that pay a strong dividend that can sustain the market turmoil. The market is dead right now, proceed with caution, there won't be much share appreciation in the near future. Cash and dividends are the way to go.