Tony C.

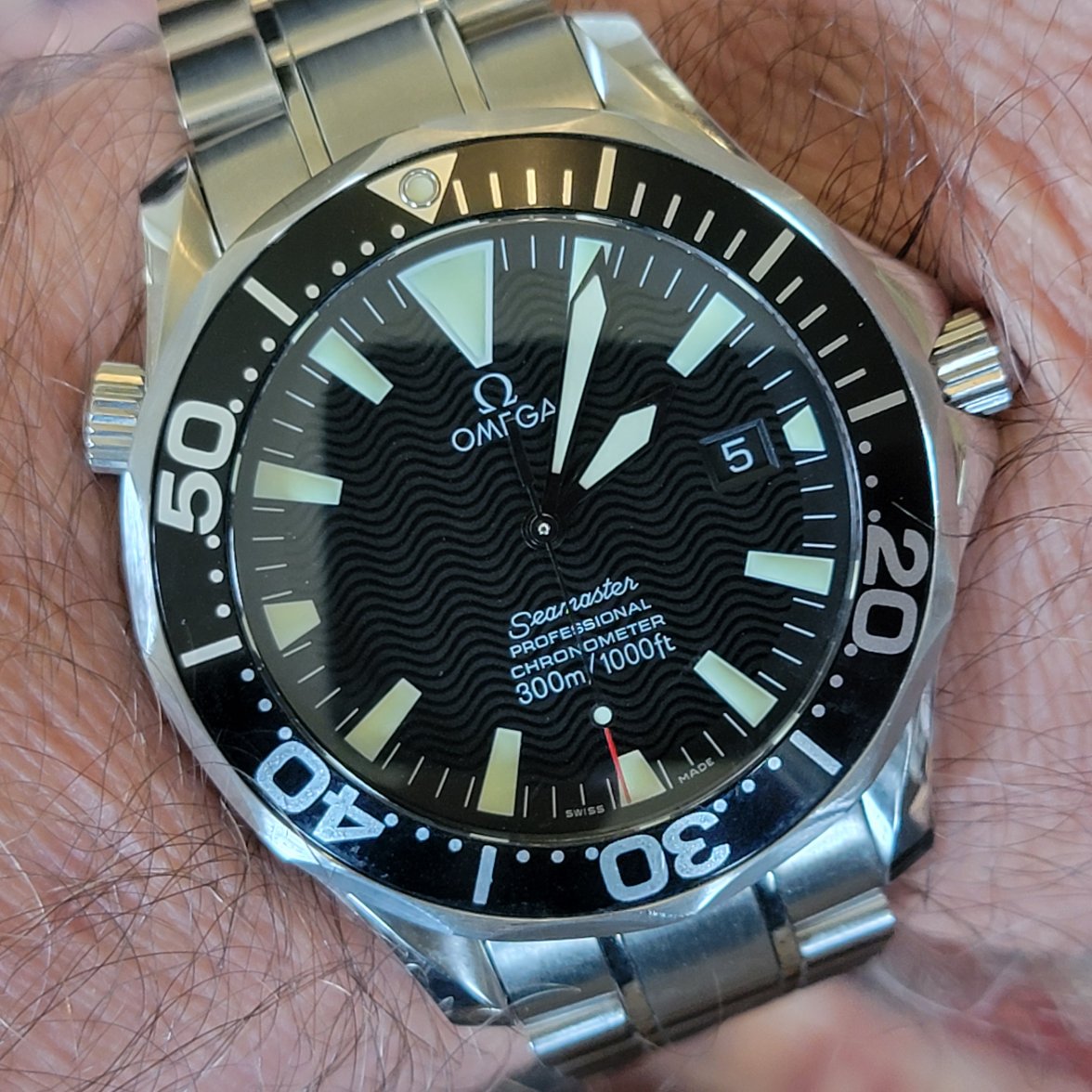

· ·Ωf Jury memberWell, it depends whether you want to flip or observe the long term. Just as an example, I bought this one (enamel dial version) around 1990 for 300 DM (=150 €). And look what is asked now, around 6,000 €. Even if we assume that a seller would get 3,000 € only, we are talking about a value increase rate of more than 10% per year, each of the 30 years. Not bad, I would think, if you think in investment terms. Even a bit better than the NASDAQ since 1990.

Your calculations are not inflation adjusted, which renders them inaccurate. But even taking the thrust of your point, I wouldn't say that the rise in values of vintage watches are likely to mirror those of the last 35 years, and for a variety of reasons.

Edited:

. I might, however, be completely wrong, but I do not mind. I am even then a lot better off than all those who had in the past year jumped onto the "Rolex rush" train ...

. I might, however, be completely wrong, but I do not mind. I am even then a lot better off than all those who had in the past year jumped onto the "Rolex rush" train ...