Old thread, but I got curious to see what happened in 2023 (and maybe I was a little bored). I looked at sales of the regular Railmaster (not the trilogy edition nor the Aqua Terra XL). As far as I know, all versions of this watch were in stock and readily available directly from Omega (via the web) for $5200/$5500 (strap/bracelet) and then $5400/$5700 after the mid-year price increase. To keep things simple, I think we can say that the average price for a new Railmaster in 2023 was $5450. That includes free shipping as well as full Omega customer service, warranty, etc. (This is, of course, really a worst case estimate, as the watch is also available new from ADs who would likely offer at least some discount.)

Some of the liveautioneers.com sales for this watch looked totally legit, but three auction houses stood out. These were three of the highest volume sellers in 2023. Here are the results for those three houses: the total number of sales in 2023 and the average selling price (which includes the mandatory buyer's premium). Shipping costs not included.

Pacific Global Auction: 23 @ $6485

Golden Gate Auction: 26 @ $6487

3 Kings Auction: 15 @ $6800

Some interesting observations from this data:

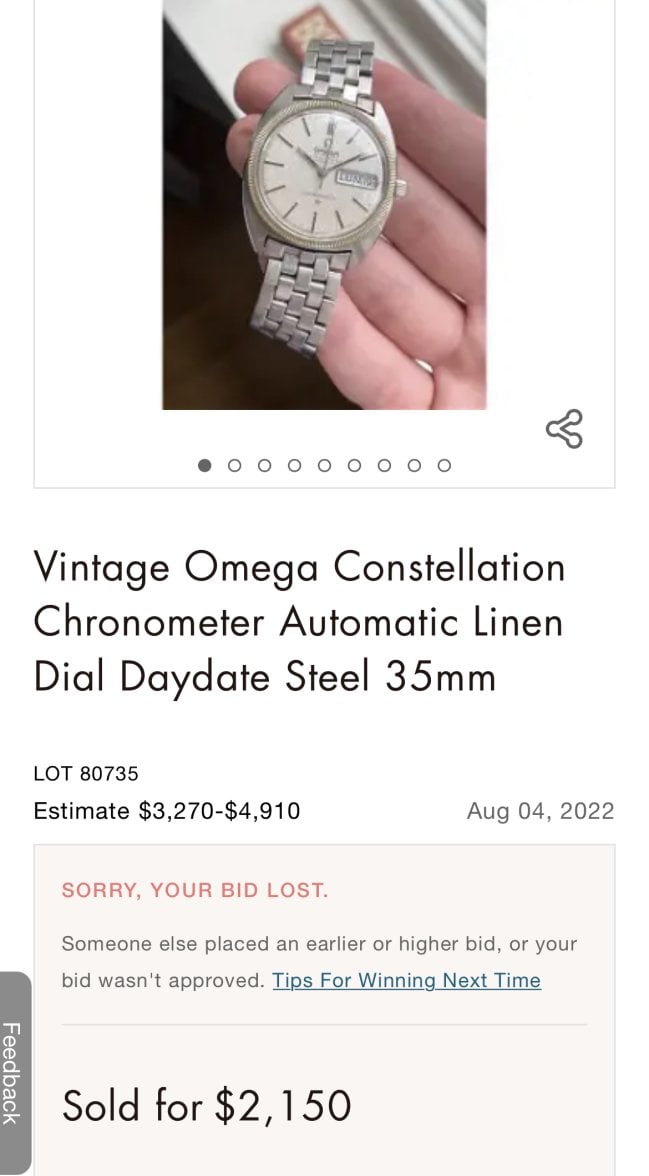

1. The photographs included with the listings were

not photographs of the actual watches being offered. They weren't stock marketing images from Omega, but, rather, photos of a used watch (in very good condition). However, all of the photos for any particular reference

were of the same watch. So unless, for example, PGA sold the exact same 220.12.40.20.01.001 watch nine times in 2023, they were simply re-using photos. In fact, the same photos were used for watches sold in 2022 and 2024 as well.

2. It's even weirder: all three of the auction houses listed above used the same photographs. And it's not just an occassional image showing up in listings from multiple houses. The exact same set of images is used for a particular reference by all three houses. I think one might conclude that these "three" auction houses are actually all the same one operating under multiple names.

So the buyers of these watches were buying used watches, sight unseen, with no recourse (except possibly their credit card issuer) since "All items are sold as is, where is, with all faults, all sales are final. No refunds and no exchanges are accepted." is clear in the terms and conditions. They have no access to Omega customer service; warranty status is unknown, and they're paying an average price of $6560 plus shipping and insurance, or more than $1000 over the price for a new model!

If this were a one-off occurrence, I could believe that some bidder got carried away and overbid. But this is 64 separate sales in 2023: more than one every week.

Maybe the explanation is nothing more than "people are stupid," but WOE did have a post recently about

Watches as Tools of Money Laundering and Illicit Finance.