gostang9

·Thanks for going all this length with us! I guess you would be correct in the case of new watches. For second-hand or otherwise vintage I'm not sure. Consider an Ed White as an example: had I bought one in a previous life in 1965, I would have to pay sales tax and no additional import charges under the current EU tax harmonization in the EU. However, an Ed White maden its way to the US, changed owners a couple of times, and then would be purchased by me in 2019, living in the EU. Even though this watch was produced in CH, I would still have to pay sales tax and import duty, correct? I should have paid more attention in tax law class...

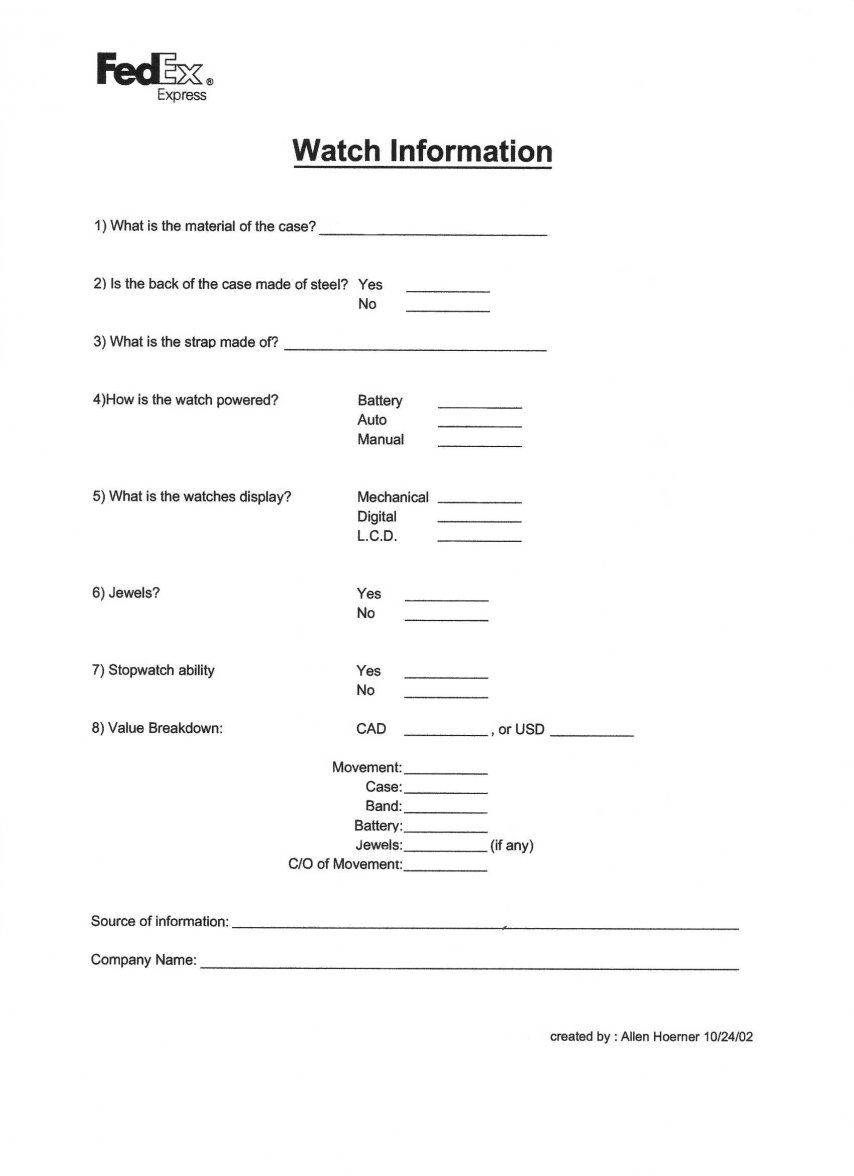

1. Import Duty owed will be dependent on the 4 items I listed in several posts above. The one additional caveat is that for some goods a Customs Officer may require a Certificate of Origin to prove the COO. However, for watches this is one of the reasons they are clearly marked on the dial as "Swiss Made". As long as the Customs Officer accepts the watch as legitimate (not a 'fake' as that would be an entirely different story) they will accept the "Swiss Made" marking as proof of COO.

2. Taxes are normally considered transactional and the rules vary by country, the product and the type of transaction:

- sometimes a tax is owed for purchase of a new item and not for a used item

--> we used to have an 7% GST and 8% PST

--->> the 7% went to Federal government for both new and used cars, while the 8% went to the Province for new cars only and not for used cars

--->>> then the GST and PST were combined under a new 13% HST 'Harmonized Sales Tax' which was charged on both new and used cars

- sometimes the tax is owed for purchase whether new or old

- sometimes the tax is owed depending on where it is purchased (applicable if bought from a dealer, not if private)

- sometimes the tax is owed depending on who is purchasing (ie: VAT can be returned or avoided if buyer is leaving the country after purchasing)

My descriptions of taxes don't answer your question, I simply share to show that taxes are complicated and very dependent on the country/province/state you live in and the type of 'transaction' you're making.

Fun stuff... plenty of government personnel, lawyers, accountants and logistics experts make a living on these very topics... 😉