ConElPueblo

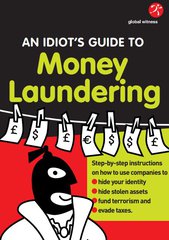

·I wouldn't at all be surprised if money laundering played a part here. The payouts when utilising casinos for money laundering (a traditional method) aren't particular high either and the act of laundering money carries great risks for the casino, which have to have anti-laundering mechanisms in place to begin with and act on any attempt to launder money or lose their license.

Remember also that a high purchasing price can justify high insurance evaluations leading to profitable insurance fraud.

In the discussion of money laundering, unique assets such as works of art are far more difficult to move on and are more difficult to handle. Stainless steel Rolexes? The opposite.

Remember also that a high purchasing price can justify high insurance evaluations leading to profitable insurance fraud.

I think what OF members don't get is how..literally irrelevant any watch is to a truly super rich person. 25mm and 100m paintings folks... The enitre auction today every single lot was less than 20mm usd

In the discussion of money laundering, unique assets such as works of art are far more difficult to move on and are more difficult to handle. Stainless steel Rolexes? The opposite.