My Early Seamaster 120 Divers. What to look for and what to avoid.

Shabbaz

·Yes, indeed these are lovely wayches. And because of the size you can wear them for private and business situations. My 300 is too big when wearing a business shirt.

Funny thing is, normally I dont like the C-shaped case. But with the 120 I dont mind at all. I think it's a very attractive and versatile watch.

Funny thing is, normally I dont like the C-shaped case. But with the 120 I dont mind at all. I think it's a very attractive and versatile watch.

Aludic

··@SpeedyBirthYearFunny thing is, normally I dont like the C-shaped case. But with the 120 I dont mind at all.

That's curious indeed. I have the very same thing. Whilst I like the dog leg Constellations, I do walk around the c-shaped pieces. I guess it's the bezel that makes all the difference.

- Posts

- 168

- Likes

- 465

Concretepuppy

·Mine also cost me a bit over 2,5k EUR, including bracelet and service. Well worth it as I enjoy it greatly!

that’s a nice watch right there

Sa Calobra

·Yes, indeed these are lovely wayches. And because of the size you can wear them for private and business situations. My 300 is too big when wearing a business shirt.

Funny thing is, normally I dont like the C-shaped case. But with the 120 I dont mind at all. I think it's a very attractive and versatile watch.

I have exactly the same. Not into C-shaped connies, but really liking this. And indeed - a bit more 'wearable' than the SM300.

Davidt

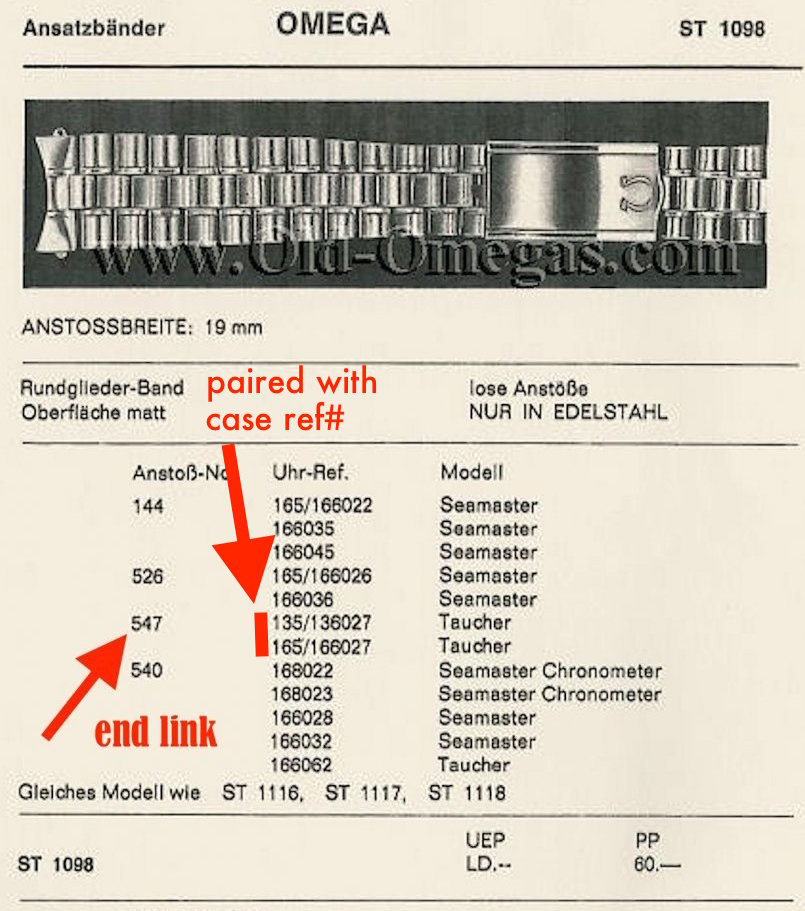

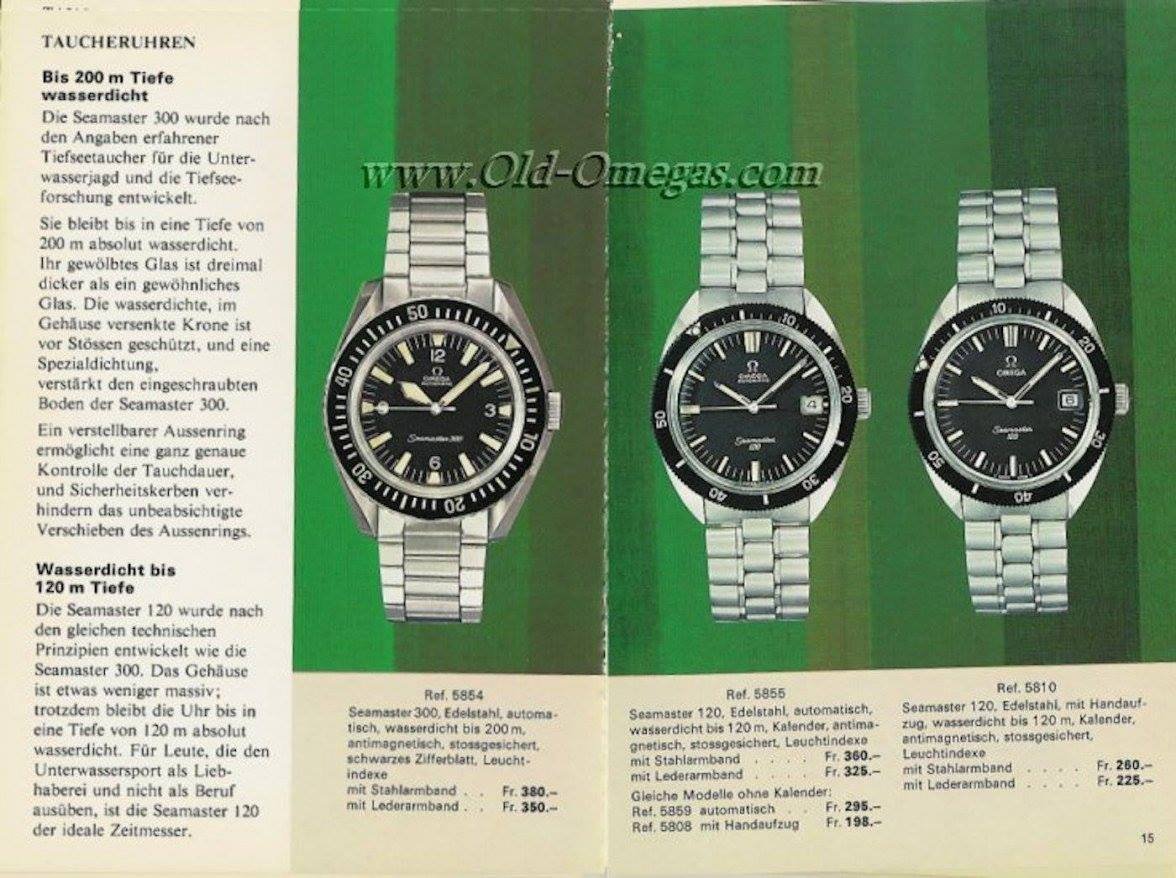

·The bracelet options are;

1. 1098 with 547 (although mine came with 540 Endlinks which seem to also fit).

2. 1069 with 524 endlinks.

3. 1067 (or 1035) with 532 end links. This is my personal favourite but 532’s seem hard to come by (I’ve currently got a wtb add as I only have one and need another).

1. 1098 with 547 (although mine came with 540 Endlinks which seem to also fit).

2. 1069 with 524 endlinks.

3. 1067 (or 1035) with 532 end links. This is my personal favourite but 532’s seem hard to come by (I’ve currently got a wtb add as I only have one and need another).

JwRosenthal

·Just a note on the 1098 and 1069, these seem to be identical to JB Champion bracelets made for other makers (Bulova, Longines, Wittnauer), which of course leads us to belief JBC made them for Omega. I have found that the links swap perfectly so….just throwing that out there.

Shabbaz

·Sa Calobra

·Thanks for all the tips, I will dive into it and report back.

Coming back to the watch that was for auction..there was a reserve price which was not met. So its up for sale again..lets see where the 2nd round brings us.

Coming back to the watch that was for auction..there was a reserve price which was not met. So its up for sale again..lets see where the 2nd round brings us.

Davidt

·Thanks for all the tips, I will dive into it and report back.

Coming back to the watch that was for auction..there was a reserve price which was not met. So it’s up for sale again..let’s see where the 2nd round brings us.

Did it definitely miss the reserve or could it be the buyer backed out?

cristos71

·I agree with your values- but as we have seen here (and elsewhere since we all are always looking even if not buying) it is indeed really hard to find an honest 120 in nice shape. It was never “easy” before, but word is out on these and it’s a sellers market.

I think there is also the collectors divide which we don’t really account for. Sure, as a seasoned collector we may say “I wouldn’t pay more than $2k for a really clean one and above that is nuts”, but then if pressed on how much it would take to part with one we already own, the numbers magically go upward “an offer under $3k for my really clean one is insulting!”.

Reality is somewhere in between.

A good point and for me a watch always has two values, the value that I'd be prepared to pay and the minimum value I'd be prepared to sell at. These numbers are generally not the same and in an ideal world I'd only be buying watches at a level somewhere below my minimum selling price, not because I'm adding to my collection with future profit in mind but more as a hedge against a broad drop in vintage values in general.

I also agree that the longer a collector has been collecting the wider the gap between those two numbers can/will be. I find it sometimes difficult to answer buying/selling value questions from members as the gap can sometimes be quite large and it all depends on which side of the fence you are sitting.

Davidt

·As well as the spread between a collectors buy/sell price, most collectors have two sell prices (or I certainly do).

There my normal sell price if I decide to sell a watch and there’s the ‘offer I can’t refuse’ price when it’s one I’m not looking to sell. Obviously the price to make me part with one I’m not otherwise looking to sell will be considerably greater than the price I’d put on a watch I’m actually listing for sale

There my normal sell price if I decide to sell a watch and there’s the ‘offer I can’t refuse’ price when it’s one I’m not looking to sell. Obviously the price to make me part with one I’m not otherwise looking to sell will be considerably greater than the price I’d put on a watch I’m actually listing for sale

Sa Calobra

·Did it definitely miss the reserve or could it be the buyer backed out?

Backing out is typically very hard at catawiki. You need to have proof that it was misrepresented and it takes about a week for them to reach a verdict on it. Also if buyer doesnt pay, it typically takes longer with reminders etc.

JwRosenthal

·A good point and for me a watch always has two values, the value that I'd be prepared to pay and the minimum value I'd be prepared to sell at. These numbers are generally not the same and in an ideal world I'd only be buying watches at a level somewhere below my minimum selling price, not because I'm adding to my collection with future profit in mind but more as a hedge against a broad drop in vintage values in general.

I also agree that the longer a collector has been collecting the wider the gap between those two numbers can/will be. I find it sometimes difficult to answer buying/selling value questions from members as the gap can sometimes be quite large and it all depends on which side of the fence you are sitting.

snunez

·A good point and for me a watch always has two values, the value that I'd be prepared to pay and the minimum value I'd be prepared to sell at. These numbers are generally not the same and in an ideal world I'd only be buying watches at a level somewhere below my minimum selling price, not because I'm adding to my collection with future profit in mind but more as a hedge against a broad drop in vintage values in general.

I also agree that the longer a collector has been collecting the wider the gap between those two numbers can/will be. I find it sometimes difficult to answer buying/selling value questions from members as the gap can sometimes be quite large and it all depends on which side of the fence you are sitting.

cristos71

·There's a name for this psychological bias: the endowment effect. Basically, we all inherently overvalue what we already own.

I read the link and it was interesting to read the theory behind what has always felt like a natural emotive reaction based purely on gained experience perhaps coupled specifically with a rising market.

JwRosenthal

·There's a name for this psychological bias: the endowment effect. Basically, we all inherently overvalue what we already own.