I don't understand the recent Rolex SS craze/shortage. What am I missing?

Nobel Prize

·Since I was curious, I took a glance around and (in short - so likely also too simplified), I don’t find any proof that the Hans Wilsdorf Foundation is a tax-exempt entity (fully or partially), but a good bit of info that suggests people could be confused by it.

Some salient bits of Swiss law (from the armchair), which - once oriented to - sort of draws into question all the reiterated comments about a “non-profit,” etc.

1. Switzerland has no legal entity equivalent of a “trust” (though by The Hague Trust Convention recognize trusts established under foreign jurisdictions)

2. Switzerland instead has (basically) foundations or associations

3. We know Rolex SA and it’s subsidiaries are owned by the “Hans Wilsdorf Foundation” (which we assume is established under Swiss foundation law)

4. A foundation may be set up for a wide range of purposes, from management of a company to an ecclesiastic or charitable focus; founders are free to define the purpose of the foundation as they see fit

5. There is no legal concept of "charity" under Swiss law; the concept corresponding to the notion of charity is the tax law concept of "public utility"

6. Not all Swiss foundations fulfill a “public utility”; it depends on whether the foundation pursues certain purposes and complies with certain oversight requirements

7. Foundations that are not a “public utility” are taxed on both their net profit and capital, though at a rate lower rate (4.5% at federal level) than the standard corporate tax (~8.5% at federal level)

8. Conversely, foundations formed “exclusively to serve a public utility purpose” can be exempt from all profit and capital taxes; a foundation that combines commercial purposes with its purposes of public utility can have a partial tax exemption

9. If a foundation benefits from a tax exemption it must comply with the requirements on an ongoing basis; so, the Swiss tax authorities verify compliance when the entity files its annual tax return with audited accounts to the tax administration.

10. Additionally, the Swiss Supervisory Authority of Foundations has monitoring an compliance authority over foundations, with foundations providing an annual report including an annual activity report, an audit report (from an external and independent auditor), and the accounts of the foundation.

11. The requirements to be fully or partially tax exempt are - on paper - sort of esoteric and meaningless, and alone I don’t think could possibly tell us anything about the status of the Hans Wilsdorf Foundation, but to roughly boil down the elements of qualification:

• must be a Swiss company

• the entity must pursue a public utility purpose (which include activities of a charitable, humanitarian, health, ecological, educational, scientific or cultural nature) and of general interest (aimed at an unrestricted circle of beneficiaries)

• that purpose must be pursued “effectively” (basically a diligence and legitimacy standard)

• there be a lack of “self-interest,” which practically speaking entails for example the members of the foundation board/or executive committee not be remunerated (though in the canton of Geneva, the practice of the tax administration allows a remuneration for time spent, so long as it does not exceed the one paid for attendance of official commissions in Geneva)

At this point, I looked around to find any evidence that the Hans Wilsdorf Foundation was either completely or partially tax exempt, in fact. That it is a Swiss “foundation” alone does not determine that tax status. It is not necessary, for reasons outlined above, that a Swiss foundation be a “public utility” (fully or partially) at all - it could simply be a foundation, that happens to perform charitable missions (like almost any public-facing corporation), but that does not qualify for or cooperate with the tax exemption status requirements and monitoring.

A few seemingly authoritative sources cited what *used* to be the foundation’s stated statutory “mission” (but one source suggests the mission statement has been changed in recent years, and is currently unknown): “to support The Geneva Watchmaking School, the Industrial Arts department at The School of Decorative Arts in Geneva, the Faculty of Economic and Social Sciences at the University of Geneva, the Swiss Watchmaking Research Laboratory in Neuchâtel, etc., [as well as to] provide allowances for maintenance, education and assistance for the nieces and nephews of the founder and their descendants.”

I’m not a Swiss lawyer, but that last bit about upkeep of descendants seems to possibly run a bit counter to the apparent requirements for complete tax exempt status?

Having sorted only this much, I’m left mostly needing some proof that the Hans Wilsdorf Foundation is, in fact, fully or partially tax-exempt.

And otherwise, now when I see assertions about Rolex being a “non-profit,” or a “charity,” etc., I can’t help but think there’s a possible misunderstanding or mythology being propagated.

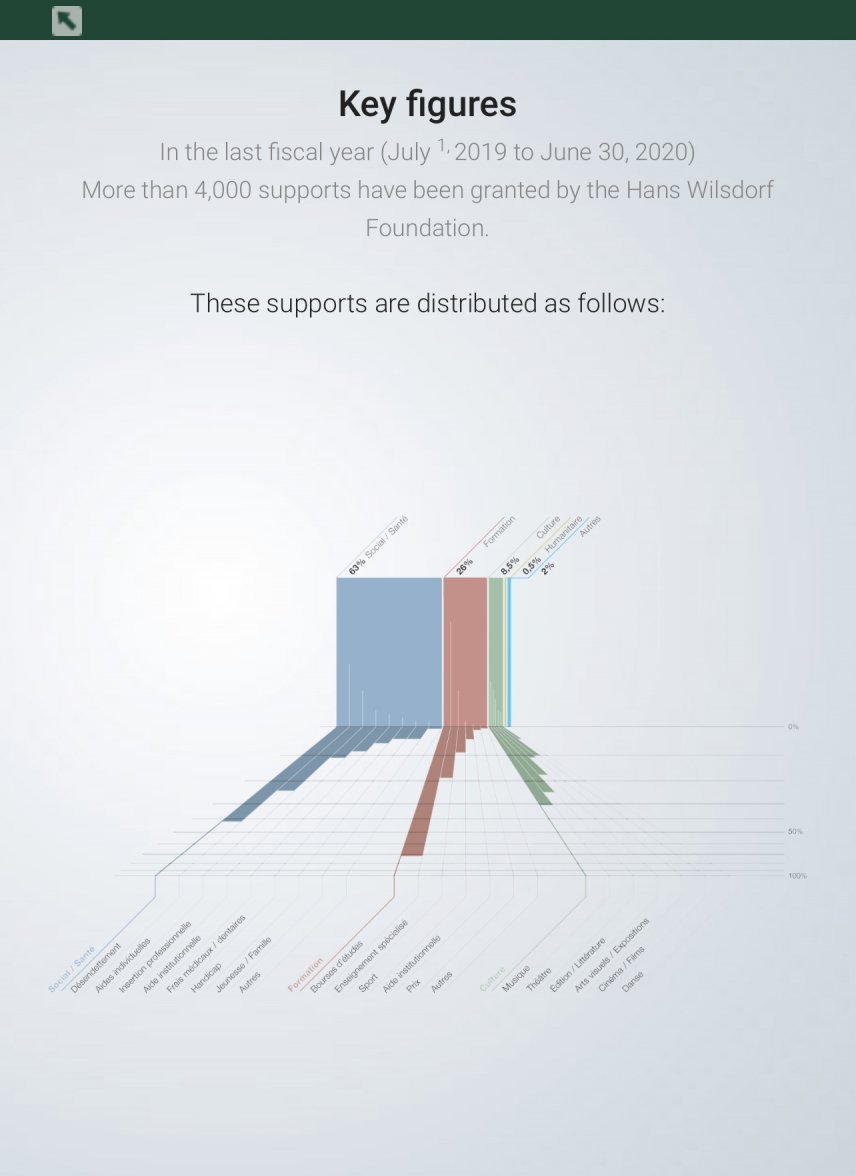

Which isn’t to say the foundation doesn’t do (even a lot of) “charitable” work (many corporations do). The foundation’s website is styled as that, in that it accepts grant proposals, and describes the (topical) distribution of its giving:

I wouldn’t be surprised to find that the foundation is a full or partial tax exempt entity as a “public utility.” But I’m also interested to see any proof of it.

When there is that proof, it alone doesn’t say much about how the foundation’s money is spent, ultimately.

Very well presented. Thank you.

In the end it may just be a way to 1. reduce corporate taxes (albeit by pledging significant amounts to "causes") and 2. reduce or eliminate the tax burden on funders and their families, if all assistance, maintenance and education is covered by the foundation (which can include pretty much anything from housing to food to travel and education) I believe the Purdue family had a similar setup. (not 100% sure).

Anyway, I don't think we can blame any company for setting up shop the best and most efficient way possible within the legal parameters.

johnireland

·Rolex takes care of Rolex...which makes total sense. I've never understood the love one brand/hate another. Even some really ugly (IMO) watches give me something to admire. The famous Ferrari driver, John Pogson, also wondered about that in car enthusiasts and did a very nice video on it. john pogson Mondial - Search (bing.com)

Watch enthusiasts might get something out of watching it.

Watch enthusiasts might get something out of watching it.

speedbird

·The only thing I’ve really noticed lately are the compliments I’ve been receiving on my GMT 16700. It used to be no one noticed it, but lately it’s probably a compliment every couple weeks or so. Seems to be mostly younger guys, 20s usually.

Donn Chambers

·Keeping this thread alive.

wanted to add a perspective/forecast from May 2022. I’ve recently seen a lot of YouTube pundits (also Gray Market dealers) talking that a price-correction is coming soon based on what they have seen in the market.

I don’t know about that, but I checked a big gray market dealer’s site and found they had a higher than normal amount of stock available for several SS Rolex Models:

12 new Rolex Explorer models

12 Pepsi GMTs

8 Batman/Batgirl GMTs

Didn’t bother counting subs, but they had a lot.

Their prices weren’t any cheaper, but I can’t believe they can hold onto the stock for too long without dropping prices. And I suspect they aren’t going to pay flippers as much with that much stock (or want to buy some models at all).

So maybe we’ll start to see pieces for sale at ADs soon if the flippers can’t make an immediate huge profit?

wanted to add a perspective/forecast from May 2022. I’ve recently seen a lot of YouTube pundits (also Gray Market dealers) talking that a price-correction is coming soon based on what they have seen in the market.

I don’t know about that, but I checked a big gray market dealer’s site and found they had a higher than normal amount of stock available for several SS Rolex Models:

12 new Rolex Explorer models

12 Pepsi GMTs

8 Batman/Batgirl GMTs

Didn’t bother counting subs, but they had a lot.

Their prices weren’t any cheaper, but I can’t believe they can hold onto the stock for too long without dropping prices. And I suspect they aren’t going to pay flippers as much with that much stock (or want to buy some models at all).

So maybe we’ll start to see pieces for sale at ADs soon if the flippers can’t make an immediate huge profit?

Orinoco111

·Grey market prices for Rolex do seem to be dropping markedly

johnireland

·We have been living in volatile times. And Rolex has been there before. And survived. In the past, when the market was calmer and watches stayed in inventory sometimes for months, Rolex and their Authorized Dealers were under no pressure to lower prices. Non-authorized dealers, depending on their overall strength, were the ones more likely to offer discounts...but it was paid for from their own profits. Grey market dealers are basically flippers...and the least able to hold inventory. This is why Rolex works so hard to control their inventory, so that weak sellers don't take customers away from them. But don't look for Rolex to drop their prices. If you want a brand new Rolex with all the paper work, you will have trouble finding an "incredible deal." IMO.

Donn Chambers

·We have been living in volatile times. And Rolex has been there before. And survived. In the past, when the market was calmer and watches stayed in inventory sometimes for months, Rolex and their Authorized Dealers were under no pressure to lower prices. Non-authorized dealers, depending on their overall strength, were the ones more likely to offer discounts...but it was paid for from their own profits. Grey market dealers are basically flippers...and the least able to hold inventory. This is why Rolex works so hard to control their inventory, so that weak sellers don't take customers away from them. But don't look for Rolex to drop their prices. If you want a brand new Rolex with all the paper work, you will have trouble finding an "incredible deal." IMO.

Wasn’t expecting a price break from ADs, only hoping they would actually have pieces for sale to a regular customer who walks in off the street with money, instead of selling the pieces to their “best” costumers (I.e, the flippers).

Nobel Prize

·We have been living in volatile times. And Rolex has been there before. And survived. In the past, when the market was calmer and watches stayed in inventory sometimes for months, Rolex and their Authorized Dealers were under no pressure to lower prices. Non-authorized dealers, depending on their overall strength, were the ones more likely to offer discounts...but it was paid for from their own profits. Grey market dealers are basically flippers...and the least able to hold inventory. This is why Rolex works so hard to control their inventory, so that weak sellers don't take customers away from them. But don't look for Rolex to drop their prices. If you want a brand new Rolex with all the paper work, you will have trouble finding an "incredible deal." IMO.

If you Find a Rolex at actual retail price it is now considered a steal. And Op at 5g that seels at 30g a Daytona at 14g that sells close to 50G.

So perhaps a more nuanced question is, will the gray market lower prices? And that is certainly a possibility, as to how much they will lower who knows. There is certainly a large gap to play with if the starting point is the current resale value.

johnireland

·Wasn’t expecting a price break from ADs, only hoping they would actually have pieces for sale to a regular customer who walks in off the street with money, instead of selling the pieces to their “best” costumers (I.e, the flippers).

Good point however not all their best customers are classic flippers. Many (maybe most) are modern collectors with short term attention spans. They are constantly chasing the next big fad watch (Rolex and other brands). They desperately have to have it...buy it wear it then get bored and hope to sell it for what they paid. Rolex won't give them that, so they turn to indie dealers who buy it and then try to turn it into a profit based on scarcity at ADs. Rolex dealers almost always give special treatment to clients who buy a lot of product. I can't think of a business that doesn't do this. When a new limited edition Porsche is about to come on the market, the Porsche dealers are on the phone calling their best customers to sell it before it ever arrives. A guy walking in off the street won't get put in the front of the line. Nothing is going to change that. As a guy off the street buyer, the only way to get what you want is with patience and a lot of effort shopping around...often in markets that are not near you. All of this is true with vintage watch dealers as well, though it is not as bad with them. No point in blaming Rolex or Porsche or a great restaurant if they made a great product that has high desirability.

Nobel Prize

·Good point however not all their best customers are classic flippers. Many (maybe most) are modern collectors with short term attention spans. They are constantly chasing the next big fad watch (Rolex and other brands). They desperately have to have it...buy it wear it then get bored and hope to sell it for what they paid. Rolex won't give them that, so they turn to indie dealers who buy it and then try to turn it into a profit based on scarcity at ADs. Rolex dealers almost always give special treatment to clients who buy a lot of product. I can't think of a business that doesn't do this. When a new limited edition Porsche is about to come on the market, the Porsche dealers are on the phone calling their best customers to sell it before it ever arrives. A guy walking in off the street won't get put in the front of the line. Nothing is going to change that. As a guy off the street buyer, the only way to get what you want is with patience and a lot of effort shopping around...often in markets that are not near you. All of this is true with vintage watch dealers as well, though it is not as bad with them. No point in blaming Rolex or Porsche or a great restaurant if they made a great product that has high desirability.

Edited:

SkunkPrince

·My watchmaker, who works at a Rolex dealer and is certified by Rolex to service their watches, has told me that they are producing at their maximum capacity. He tells me that they have tried multiple shifts, expanded as much as they are able, but they cannot keep up with demand.

They get a specific alotment every year and they strictly sell locally, partly because that's what Rolex wants, and partly because that's how they want to do business. As I was able to handle an Explorer 36, and also a good customer of theirs, I am on the list to buy one next spring for the $7200 list price. I do not know how many are ahead of me on the list, and I don't much care, I'll get one when one is available. I do not know (nor care) how other Rolex dealers work, I just trust my local people.

They get a specific alotment every year and they strictly sell locally, partly because that's what Rolex wants, and partly because that's how they want to do business. As I was able to handle an Explorer 36, and also a good customer of theirs, I am on the list to buy one next spring for the $7200 list price. I do not know how many are ahead of me on the list, and I don't much care, I'll get one when one is available. I do not know (nor care) how other Rolex dealers work, I just trust my local people.

JwRosenthal

·My watchmaker, who works at a Rolex dealer and is certified by Rolex to service their watches, has told me that they are producing at their maximum capacity. He tells me that they have tried multiple shifts, expanded as much as they are able, but they cannot keep up with demand.

They get a specific alotment every year and they strictly sell locally, partly because that's what Rolex wants, and partly because that's how they want to do business. As I was able to handle an Explorer 36, and also a good customer of theirs, I am on the list to buy one next spring for the $7200 list price. I do not know how many are ahead of me on the list, and I don't much care, I'll get one when one is available. I do not know (nor care) how other Rolex dealers work, I just trust my local people.

johnireland

·Not sure I agree here. an AD may have a relationship with a flipper that buys 10 or 20 watches each week and kicks back a little extra for the place in line. That cannot complete with modern collectors with short attention spans. I know this because I am a modern collector with limited if not shirt attention span and I know quite a number of gray dealers and shop owners. They get priority.

So the AD is selling for list to the flipper who pays extra to get in line and then is selling to someone else for a price well over Rolex retail? Sounds like a sort of Ponzi game where someone is very soon going to get stuck with a watch not worth the price they paid. And the market is so strong that the flipper is buying 10 to 20 Rolexes a week from an AD's stock (not sure the overall inventory from Rolex can support those numbers)? Rolex has a very long view of the interests of their company and I'm sure would love to hear about those ADs you describe. Have you considered reporting them to Rolex.

SkunkPrince

·Finally a Rolex that Tom likes!

I actually bought a $280 Seiko-branded "Explorer" to see whether I might want a Rolex, and I do.

pumpernikiel

·Interesting to read about the possible price correction. If it is about to happen i would be betting on this correction to be rather modest because Rolexes and some other branda have become a safe heaven for the capital especially in the time.of high inflation. To give an example - reportedly jewelery shops and watch dealers sold everything they had in Russia in the begining of the war when rubel plunged.

johnireland

·Interesting to read about the possible price correction. If it is about to happen i would be betting on this correction to be rather modest because Rolexes and some other branda have become a safe heaven for the capital especially in the time.of high inflation. To give an example - reportedly jewelery shops and watch dealers sold everything they had in Russia in the begining of the war when rubel plunged.

I agree that dealers might make modest price changes...but not the Authorized ones. I have all the gold bullion I want and not when I buy gold I'm making it in 18k watches. Of course, I enjoy wearing them as well...but even safe havens need to be diversified. Gold is always gold. Though rare coins are overrated as a safe haven asset...as are almost all fashion trends. 18k vintage Omega Constellations are offering some very attractive buys.

Tekashi_145.022

·I agree that dealers might make modest price changes...but not the Authorized ones. I have all the gold bullion I want and not when I buy gold I'm making it in 18k watches. Of course, I enjoy wearing them as well...but even safe havens need to be diversified. Gold is always gold. Though rare coins are overrated as a safe haven asset...as are almost all fashion trends. 18k vintage Omega Constellations are offering some very attractive buys.

Reminds me of an interview I saw with a recently retired Navy SEAL. He was reviewing his EDC for global travel - 3 things he wouldn’t be caught without - and his all-black Rolex GMT-Master II was one of his essentials. It wasn’t so much he loved the watch - it was that anyone in the world knew what a Rolex was, and in a pinch, he could use it to barter with someone to trade for a beater car to cross the border, a gun, a place to stay for a night, etc.

The global appeal of Rolex could be fueling its meteoric gray market price rises as people fear currency devaluation (or defaults in some countries’ cases), inflation, etc. If I was a resident of certain countries and considering emigrating, I’d rather have a globally-recognized asset - like a sports Rolex - than invest in local land or currency.

To your point, there are interesting value propositions in other brands. Agreed vintage 18k Connies appear undervalued (especially in comparison).

Nobel Prize

·So the AD is selling for list to the flipper who pays extra to get in line and then is selling to someone else for a price well over Rolex retail? Sounds like a sort of Ponzi game where someone is very soon going to get stuck with a watch not worth the price they paid. And the market is so strong that the flipper is buying 10 to 20 Rolexes a week from an AD's stock (not sure the overall inventory from Rolex can support those numbers)? Rolex has a very long view of the interests of their company and I'm sure would love to hear about those ADs you describe. Have you considered reporting them to Rolex.

Archer

··Omega Qualified WatchmakerRolex has a very long view of the interests of their company and I'm sure would love to hear about those ADs you describe. Have you considered reporting them to Rolex.

Rolex loves this current situation. They sell everything they make (including the dogs that once sat for months/years at AD's), the dealers are happy turning over stock, there's no discounting (that used to be common). and the only unhappy party here is the average Rolex buyer. The person that Rolex cares about the least.

Rolex has already stated in writing that they do not control distribution once it gets to the AD, and have no influence on who the AD sells to. So they have basically announced that the regular Rolex buyer is on their own, and that they have no plans to do anything at all about this.