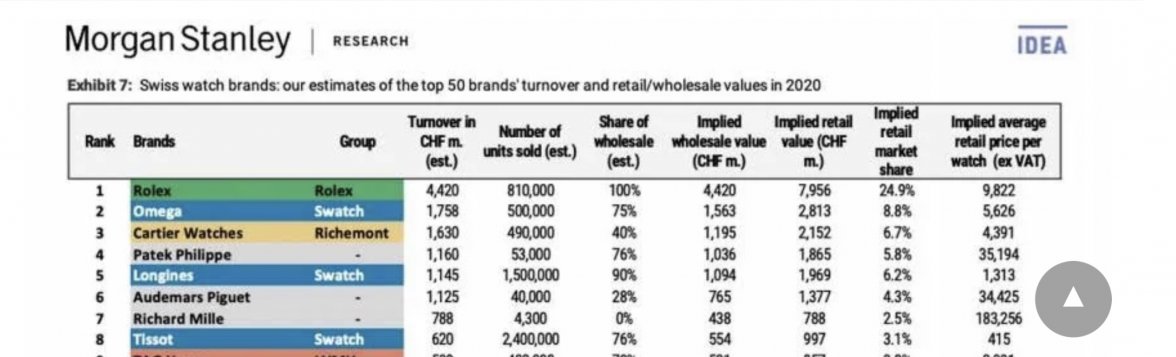

This goes back to my original question to you. Market share is not a measure of pure volume, only a share of the overall volume.

There are different ways to measure market share (eg by units sold, by value of units sold, etc.) - the report addresses these. Right or wrong, the various analysts all suggest Rolex is out front by an order of magnitude on all accounts.

Again, I’m not defending those conclusions as flawless - but trying to account for them at all amongst all the other “data” available, and recognizing at the same time that such analysts are

professionals as compared to some of the more outspoken on this thread: which to me means I really can’t dismiss the analysts data out of hand.

Again, that doesn’t leave me confident in anything other than not being confident that AD’s cases tell me anything wholistic.

The key point is that using just one year of data doesn't really reflect reality, because dealers and distributors don't clean out the entire pipeline at the end of the year and start with zero watches.

It’s not one year: the same report has Rolex on top by a significant margin going back to at least 2017 (when the current charts stop reporting historical).

Meanwhile, as another mentioned just above, while AD cases are empty, Chrono 24 is PACKED FULL of Rolex. And, I assume that for every 1 on Chrono 24, there are at least a handful more in safes “to appreciate,” in other sales platforms (eg IG), etc.

One of the main points made by the same analysts we’re discussing is that an element of Rolex’s success vs other Swiss brands like Omega is that Rolex has a tighter grip on its manufacturing tolerances and controlling secondary values, while Omega and other brands are (in analyst’s views) overproducing stock due to a bullwhip effect between point of sale and factory.

Their point, if anything, is that it’s expected Rolex cases are empty while Omega cases are full, which does not reflect their being fewer gross Rolex available (quite the opposite) but instead fewer net Rolex available after accounting for demand and manufacturing overages.

So I’m left feeling like I still might not fully understand the thrust of your point about supply chain in comparing Rolex vs Omega based on AD’s cases. If there’s a surplus of stock somewhere explaining Rolex’s “exports,” and it’s not in ADs cases, and it’s not been “sold” - where is it?