TechFounder

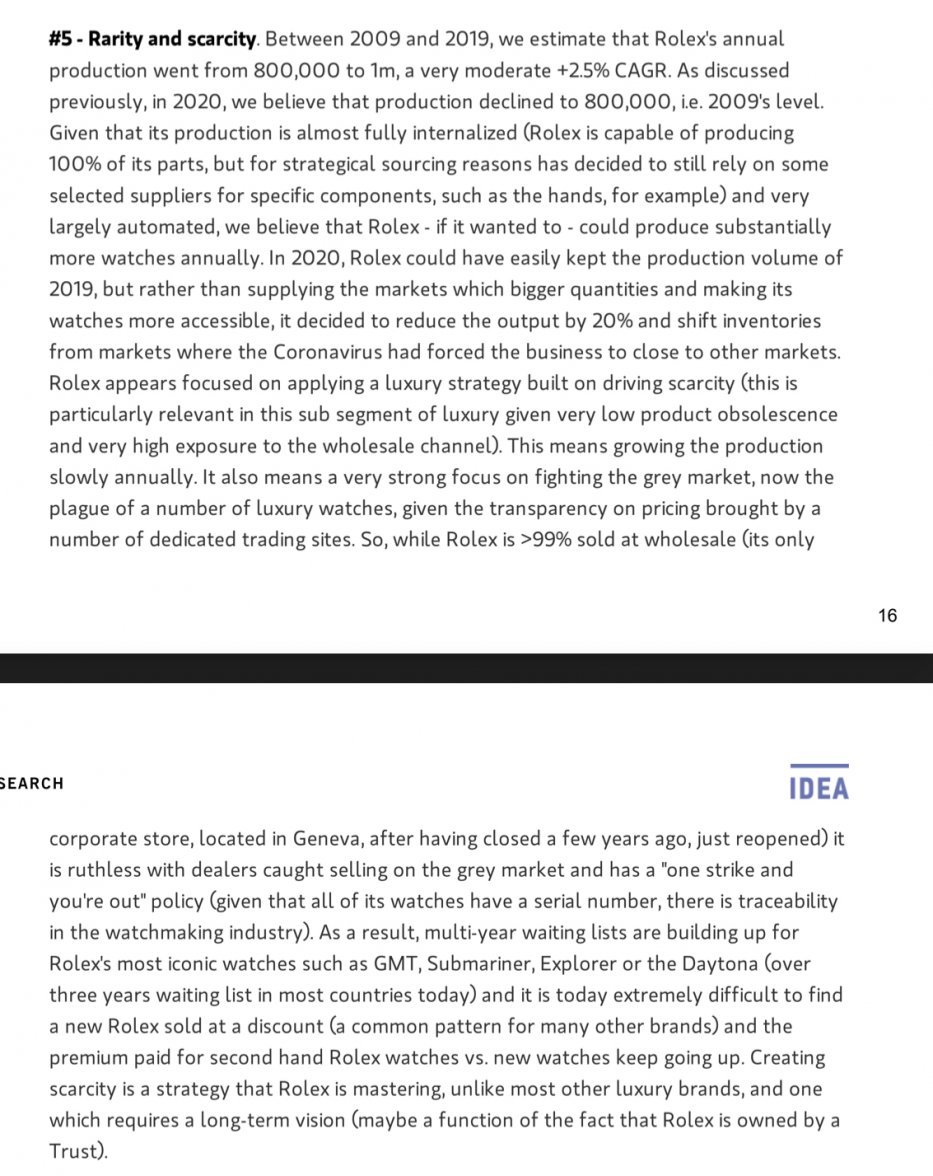

·Right, and 2020 would have been the perfect time for them to try to catch up with demand but they did the reverse. That should tell you all that you needed to know about how management is thinking about their customers.

If you look at the trend of the mechanical watch unit exports, you see that it's not moving up.

https://k8q7r7a2.stackpathcdn.com/wp-content/uploads/2021/03/swiss-watch-exports-2020-volumes.jpg

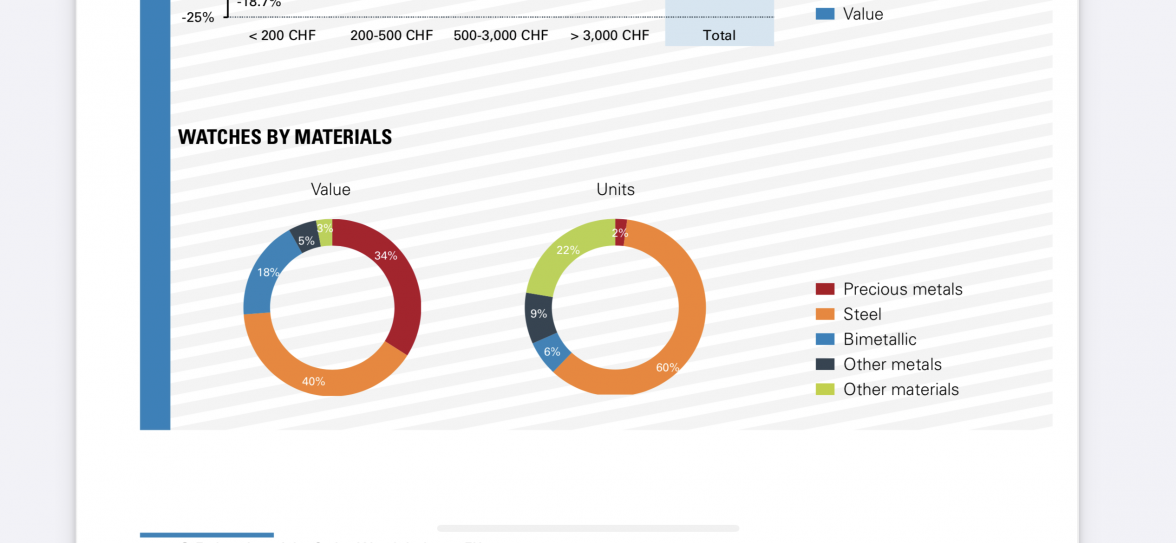

You can also see this directly on the swiss federation's site. The numbers (CHF > 3,000) plateaued back in 2015 when Rolex watches were still prevalent in the wild.

https://www.fhs.swiss/scripts/getstat.php?file=histo_gp_210101_a.pdf

If you look at the trend of the mechanical watch unit exports, you see that it's not moving up.

https://k8q7r7a2.stackpathcdn.com/wp-content/uploads/2021/03/swiss-watch-exports-2020-volumes.jpg

You can also see this directly on the swiss federation's site. The numbers (CHF > 3,000) plateaued back in 2015 when Rolex watches were still prevalent in the wild.

https://www.fhs.swiss/scripts/getstat.php?file=histo_gp_210101_a.pdf