without any actual data, I’d agree no one actually know what models are the biggest sellers, what I would say is that if you look at the fake market which is only driven by demand, the most repped models are, submariners, daytonas, GMT’s. So I’d make an educated guess that globally these are currently the most desirable models and if supply was in abundance would sell the most units. But it is only a guess.

I might think that’s a distorted proxy. The people who want to display a Rolex affect without paying Rolex pricing/willing to buy fakes and know where to purchase them, seems unlikely to represent the average Rolex buyer population.

On the contrary, a different, but obviously also totally anecdotal view: the times I’ve been in an AD/RB and seen another watch-nerd I can count on one hand; whereas there are uncountable times I’ve been in an AD/RB and seen a couple shopping for a lady date just for the Mrs., or “any Rolex will do” for the Mr.

Just as anecdotal: I’ve heard time and again that in Asia (>60% of the luxury watch market by value), precious metal pieces are wildly more popular and sought after than SS models. Could be incorrect anecdotal info.

-----

But we can get more particulate and objective on these anecdotal observations:

Let’s look at Morgan Stanley’s 2020 yearly report on the 2019 Swiss watch industry (ignoring 2020 which isn’t out yet and also so we don’t get static from the surely odd 2020 COVID year). The typical top 7 companies all achieved growth in 2019.

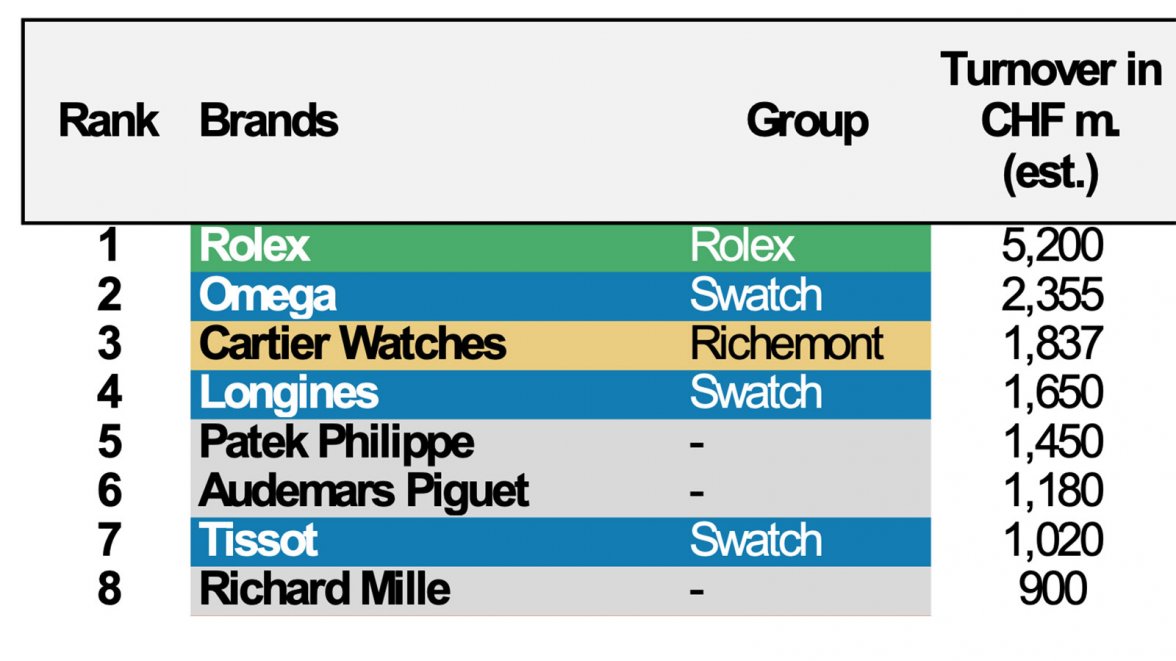

But as to the topic of this thread, check out the relative turnover in value:

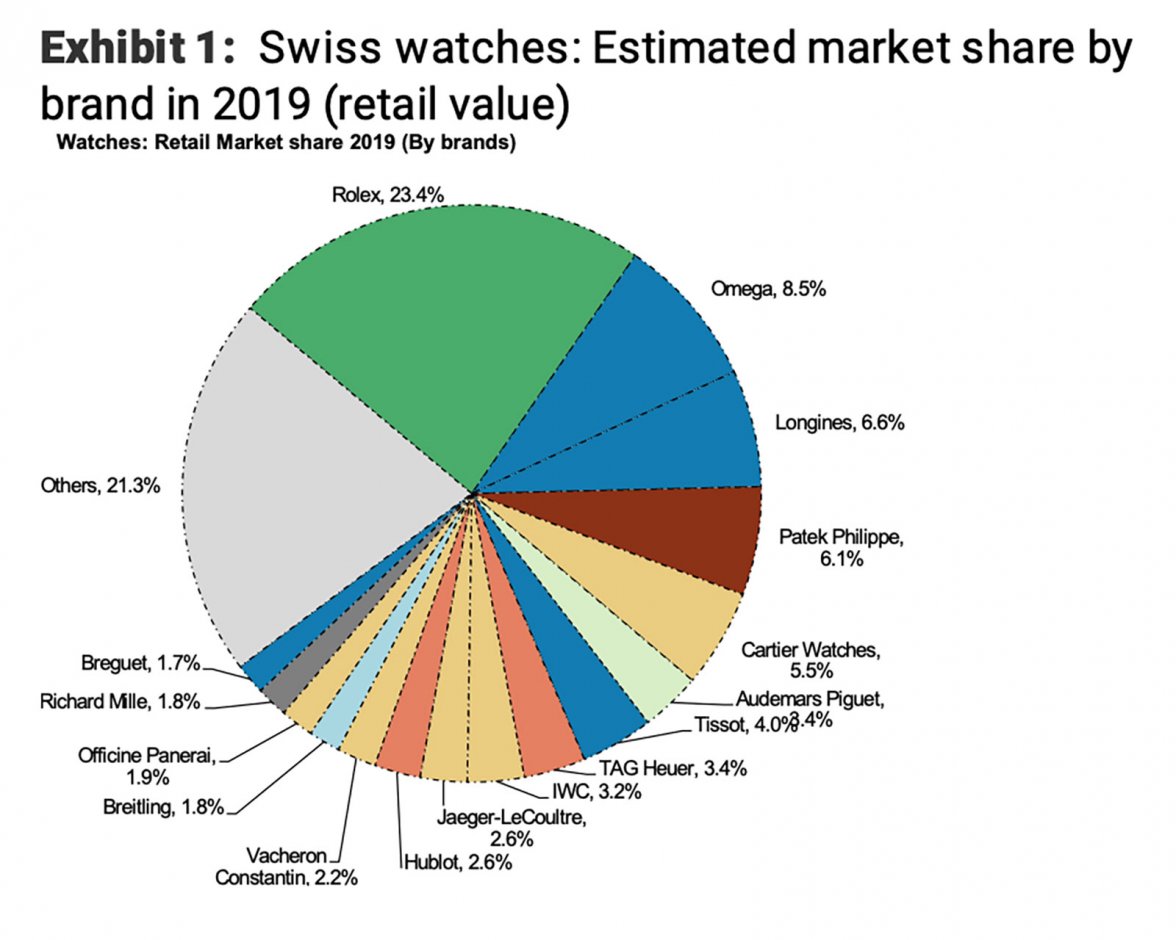

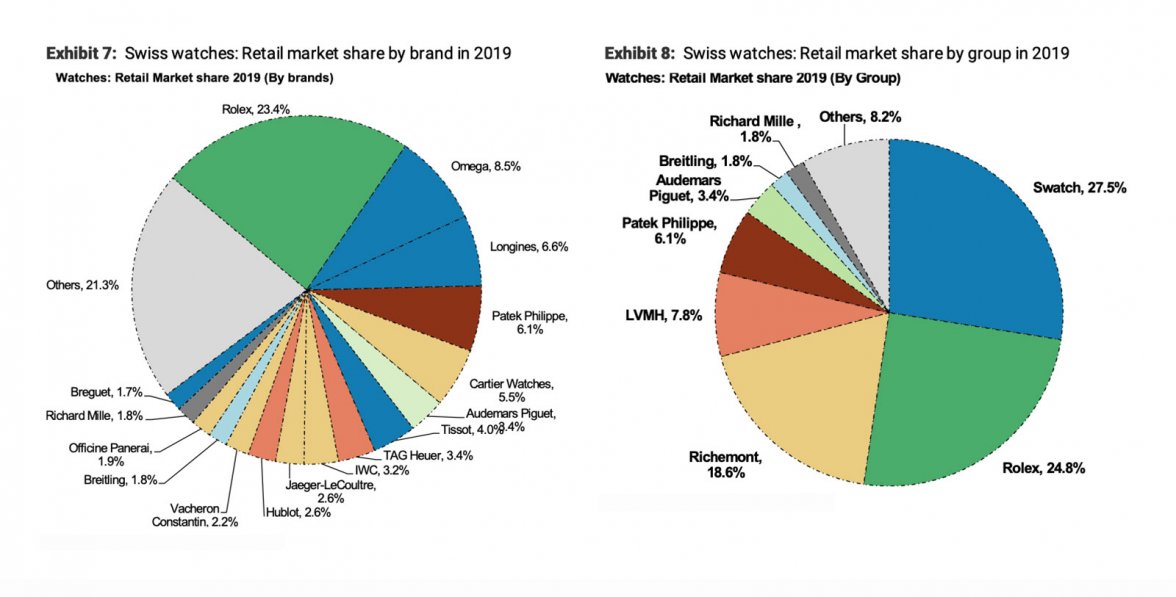

And then check out the relative market share from any perspective:

So, if this data is to be believed,

Rolex is indisputably selling a lot of units on a value basis (if not a pure unit basis).

And so, if you are a person that further believes that Rolex is

not selling a lot of desirable SS sports models (which are at MSRP far cheaper than precious metal versions), then you might be forced to agree that Rolex is selling a majority of units on a value basis that are not SS sports models.

Is this deduction supported by any objective info?

------

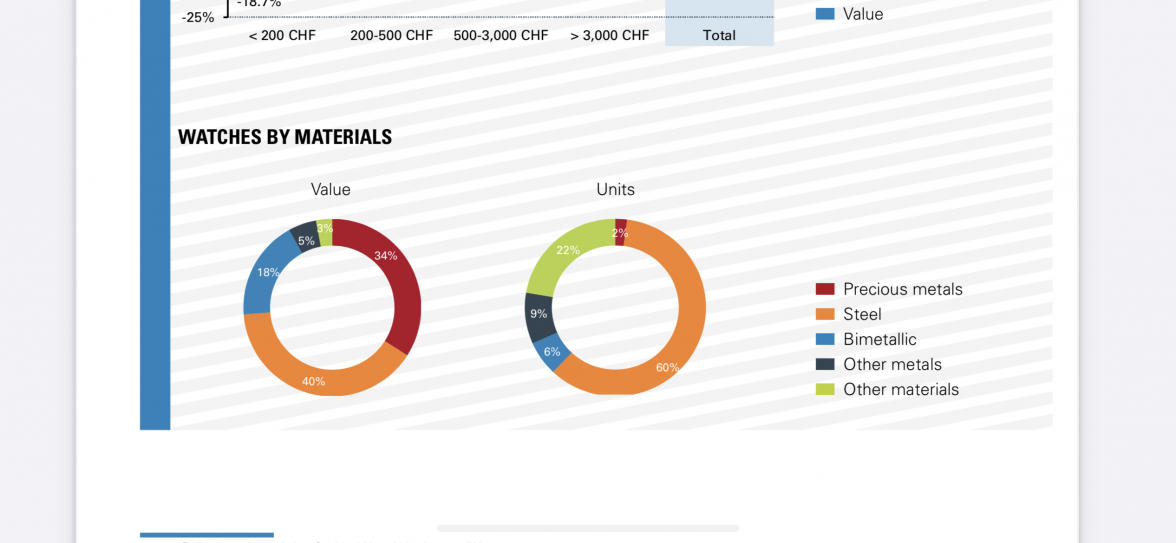

Let’s look the 2019 analysis by the Federation of the Swiss Watch Industry regarding the relative value and number of Swiss watches sold in 2019 by materials. I think we can assume for present purposes that general market demand for Swiss watches by materials might roughly reflect Rolex’s general demand profile as well, at least in rough order, by materials:

Basically, precious and bi-metal sales account for only 8% of sales by unit, but 52% of sales by value.

Used as a proxy for Rolex’s sales, it would suggest that at least 1/2 of Rolex’s income are

not derived from “SS sports models” whatsoever.

Moreover you may be forced to agree that Rolex’s income attributing or to precious/bi-metal is far in excess of 50% if you’re a person who assumes Rolex is limiting production units of SS sports models.

-------

Remembering again that by retail value Rolex is selling 3 times as many watches-by-value as Omega, this all seems to result in a catch 22 of sorts. It seems one might be forced to agree with only one of the following contradictory views:

(1) Rolex sells 3 times as many watches-by-value as Omega by selling

inordinate numbers of SS watches (which is contrary to the view Rolex is limiting SS supplies) - far more SS in fact that Omega manages to sell; or

(2) Rolex sells 3 times as many watches-by-value as Omega, all while restricting sales of SS sports models, in virtue of inordinate sales of precious metal/bi-metal watches accounting for >>50% of the company’s sales by value (contrary to the view that Rolex’s bread and butter are SS sports watches).

The take-away being this: the market statistics appear to suggest an inherent contradiction in simultaneously maintaining that SS sports models are both being restricted in number, while also accounting for a principle source of Rolex’s value.

Indeed, if Rolex’s sales-by-value are 3X that of Omega, it would seem Rolex is either selling far more SS than Omega, or instead SS sorts is for Rolex more of a “halo” product with the bulk of its annual sales value tied up in precious/bi-metal watches.

Then there’s the law of the excluded middle, which may be most uncomfortable for forum quips to swallow: the answer could be somewhere in between, where Rolex is neither materially restricting SS sports sales nor having a significant majority of sales-by-value in precious metals, but instead simply

selling the everloving sh*t out of all kinds of things, to the tune of 3X as many watches-by-value as the next runner up in industry, Omega.