And now the waiting begins....

1st speedy

·This was coming from Spain to Australia, then add in customs/tax clearances, 1 week is pretty good!

1st speedy

·Gorgeous watch. Congrats!!

osc

·Very nice. Congrats on the watch and it was fun trying to keep up and guess what was coming in

Fickle

·Wow nice find, one of my faves!

lindo

·Incidentally, as another Australian who has had to pay clearance assessment fee, import duty and GST, what extra charges did you have to pay to clear Customs? (Unless it slipped straight through in the mail, in which case extra congratulations are in order).

CanberraOmega

·Incidentally, as another Australian who has had to pay clearance assessment fee, import duty and GST, what extra charges did you have to pay to clear Customs? (Unless it slipped straight through in the mail, in which case extra congratulations are in order).

i paid 10% of the declared value, plus $129. I still don’t have a receipt from DHL for the GST. So I’m not sure if part of that was 10% on the shipping costs, as the invoice price included shipping.

verithingeoff

·Are the charges paid up front?

A few years ago when I was collecting vintage guitars I had to deal directly with the various agencies after the guitar had landed in Australia.

A few years ago when I was collecting vintage guitars I had to deal directly with the various agencies after the guitar had landed in Australia.

lindo

·It was shipped by DHL, so definitely didn’t slip through!

i paid 10% of the declared value, plus $129. I still don’t have a receipt from DHL for the GST. So I’m not sure if part of that was 10% on the shipping costs, as the invoice price included shipping.

Thanks. That is roughly in line with what I paid, but I could not get clarity from DHL on exactly how their charges were calculated.

To return to your watch, it is a very nice acquisition.

CanberraOmega

·Are the charges paid up front?

A few years ago when I was collecting vintage guitars I had to deal directly with the various agencies after the guitar had landed in Australia.

Damo

·Very nice indeed, well worth the wait 😀

- Posts

- 133

- Likes

- 65

mk2rick

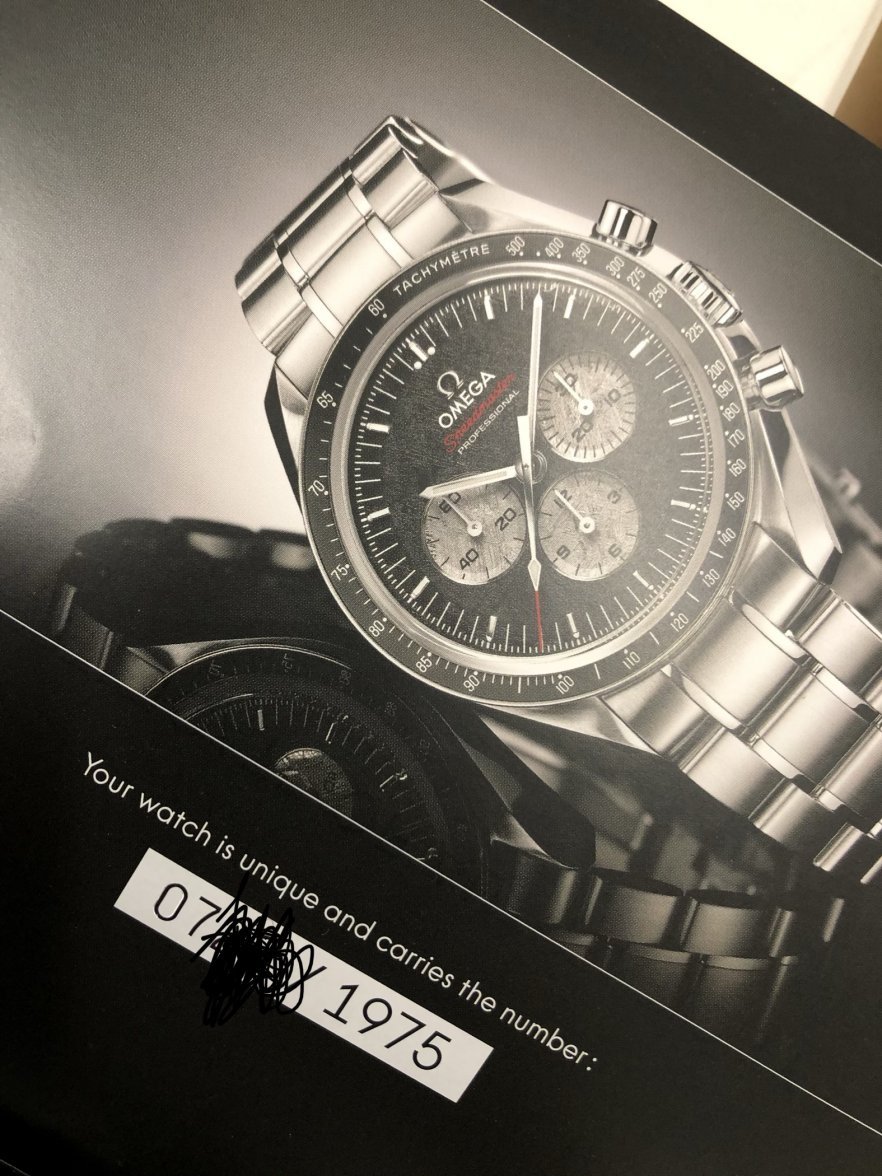

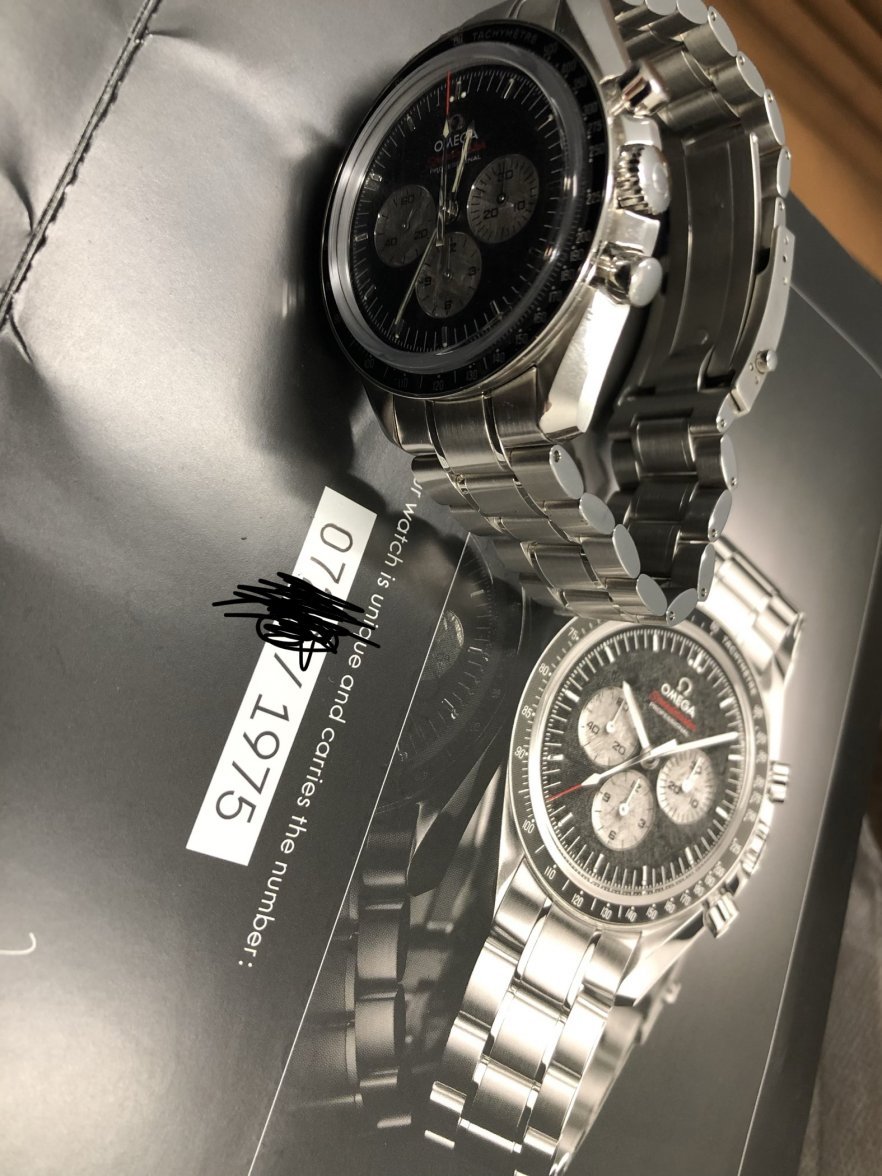

·BNIB, complete with a warranty card with the date of payment! So it’s a 10yr old watch, but still under warranty!

- Posts

- 2,326

- Likes

- 7,545

pongster

·The one on the right

Meteoright?

Congrats. It’s one of the LE apollo speedies that also intrigue me.

Dr.K

·Great to hear!!!

LemansBoiler

·Such a cool watch! I didn’t get the appeal until I held one in my hands. Congrats!

speedydownunder

·That strap is excellent.

May I please have contact details?

thx

May I please have contact details?

thx

Similar threads

- Posts

- 15

- Views

- 2K

- Posts

- 14

- Views

- 3K

- Posts

- 78

- Views

- 19K