dsio

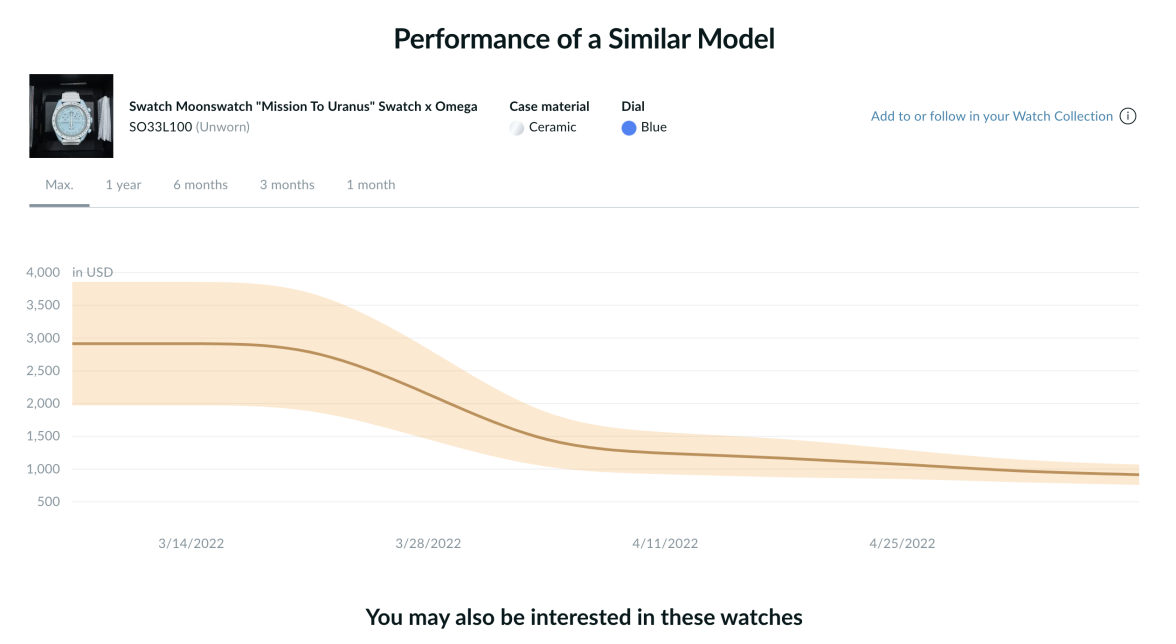

··Ash @ ΩFI had a mate who was a fairly big speculator on Rolex unload all but the 6 pieces he intends to wear himself over the last couple of months and he's pretty happy to be out of them now given the recent dip, probably 60-80 of the most sought after steel models and a dozen in gold. One of the local dealers he was unloading them through was only taking modern Rolex on consignment towards the end of that as he's worried they're not as stable as they were just months ago.