Spacefruit

··Prolific Speedmaster Hoarderhttps://www.sothebys.com/en/buy/auc...left_to_bid&utm_medium=email&utm_source=zaius

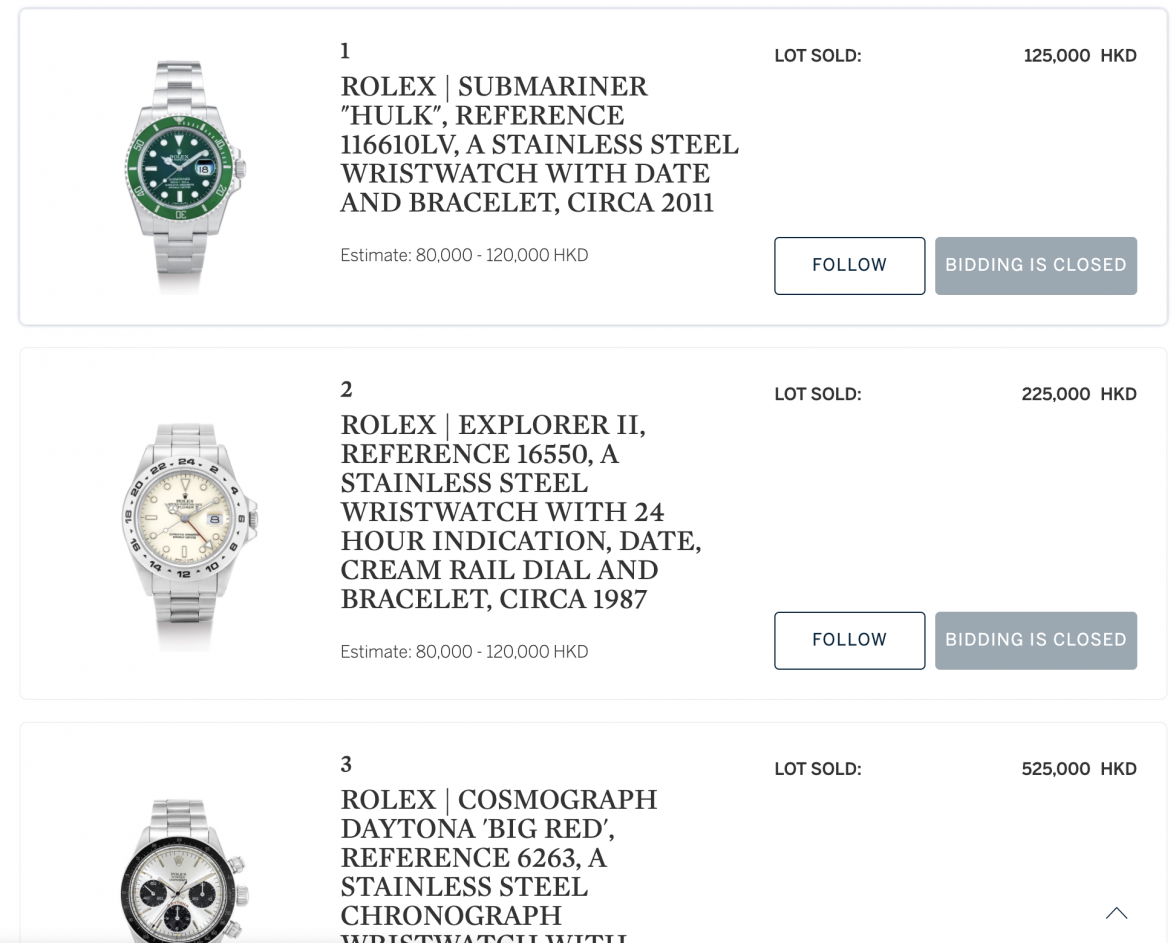

(Edit: I was too quick off the mark to see the results, which are now present. All sold, most around high estimate. Pretty good result , and goes against the thrust of my post which is that online auctions wont be popular!)

So Sotheby’s like many B&M auctions, in response to spiralling IRL costs of running an auction, are trying to push all of us to online auctions - frontline staff at three of the biggest houses have told me in the last year that “they can’t make enough money to survive” on their physical auctions.

like many board level decisions that sound good, these high reputation houses shifting to online is surely misguided. I go to the big auctions for fun really, as almost nothing I bought in last four years (with a notable exception) was a bargain. I meet other collectors, some dealers and talk to others first hand at the viewings and generally expand my knowledge.

if I am going to buy online, eBay is, in spite of its best efforts to destroy itself as a safe watch trading place, the best source for one owner or interesting finds.

last time I looked, online big house auctions still mark up the staggering 25% premium. Added to that is that they have to take a high percentage of trade items to fill the list. So these houses want us to sit at home, bid on a high value watch without handling it, and pay the exorbitant fee without the free cappuccino in the Grand Hyatt Ballroom at the viewing.

I see no attraction for me bidding online with one of the big houses - at the very least I am thinking, if this watch is any good they will have it in a live Geneva / HK /NY auction.

(Edit: I was too quick off the mark to see the results, which are now present. All sold, most around high estimate. Pretty good result , and goes against the thrust of my post which is that online auctions wont be popular!)

So Sotheby’s like many B&M auctions, in response to spiralling IRL costs of running an auction, are trying to push all of us to online auctions - frontline staff at three of the biggest houses have told me in the last year that “they can’t make enough money to survive” on their physical auctions.

like many board level decisions that sound good, these high reputation houses shifting to online is surely misguided. I go to the big auctions for fun really, as almost nothing I bought in last four years (with a notable exception) was a bargain. I meet other collectors, some dealers and talk to others first hand at the viewings and generally expand my knowledge.

if I am going to buy online, eBay is, in spite of its best efforts to destroy itself as a safe watch trading place, the best source for one owner or interesting finds.

last time I looked, online big house auctions still mark up the staggering 25% premium. Added to that is that they have to take a high percentage of trade items to fill the list. So these houses want us to sit at home, bid on a high value watch without handling it, and pay the exorbitant fee without the free cappuccino in the Grand Hyatt Ballroom at the viewing.

I see no attraction for me bidding online with one of the big houses - at the very least I am thinking, if this watch is any good they will have it in a live Geneva / HK /NY auction.

Edited: