watchyouwant

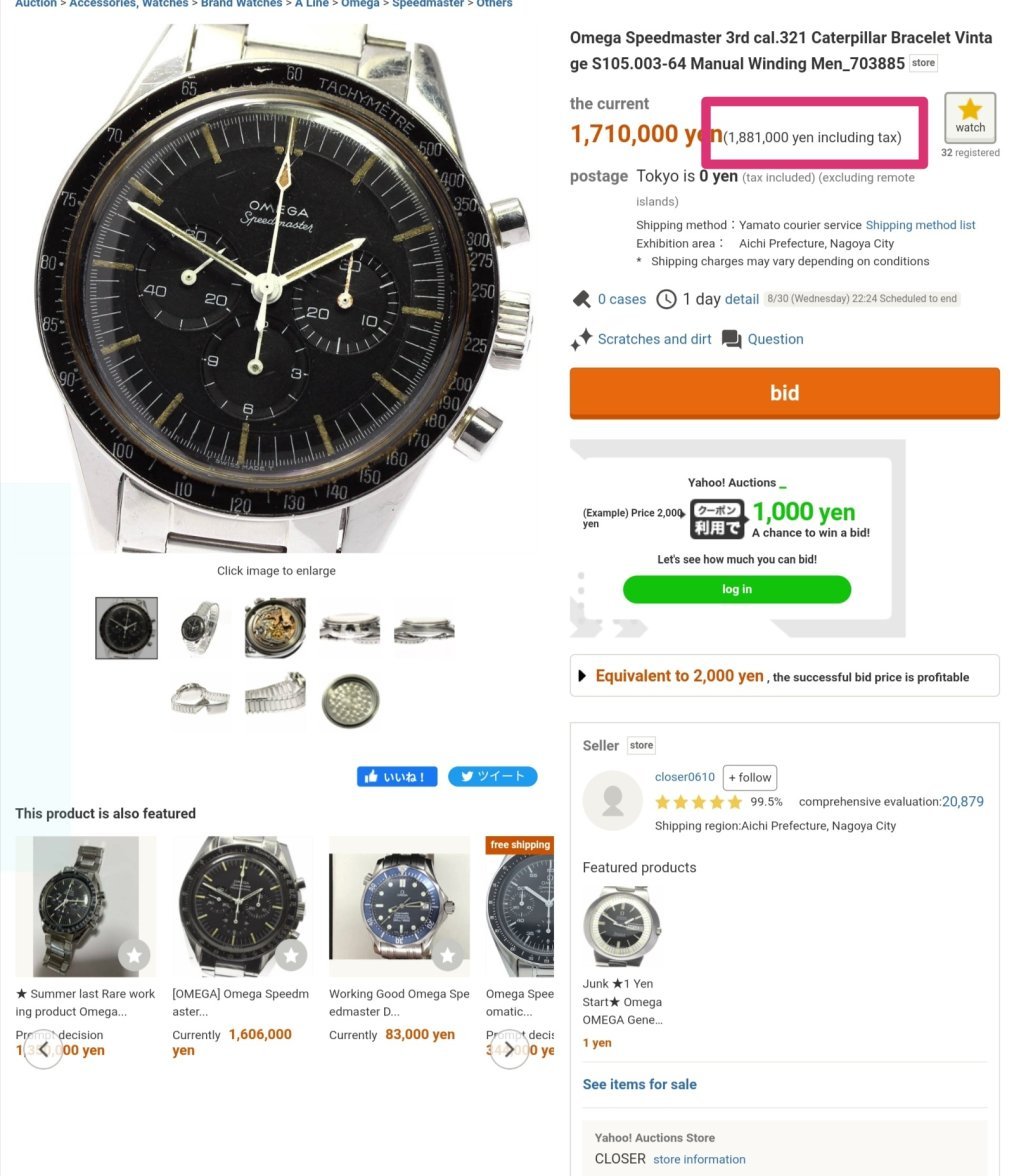

·If you use a Japanese Proxy Company to bid on your behalf on a Japanese Yahoo auction for a used Watch, they do business inside of Japan on your behalf and that will often include the 10% japanese Consumption Tax ? Correct ? Or not for second hand transactions? If that is correct, must the Proxy company refund the paid consumption tax to the foreign Customer and claim it back in their japanese Tax return from the japanese government? there is a process, but does that apply to used and exported watches as well ? if not, the original seller to the proxy company inside japan keeps the 10% Tax and makes a windfall profit of 10% extra ? Did i miss something?