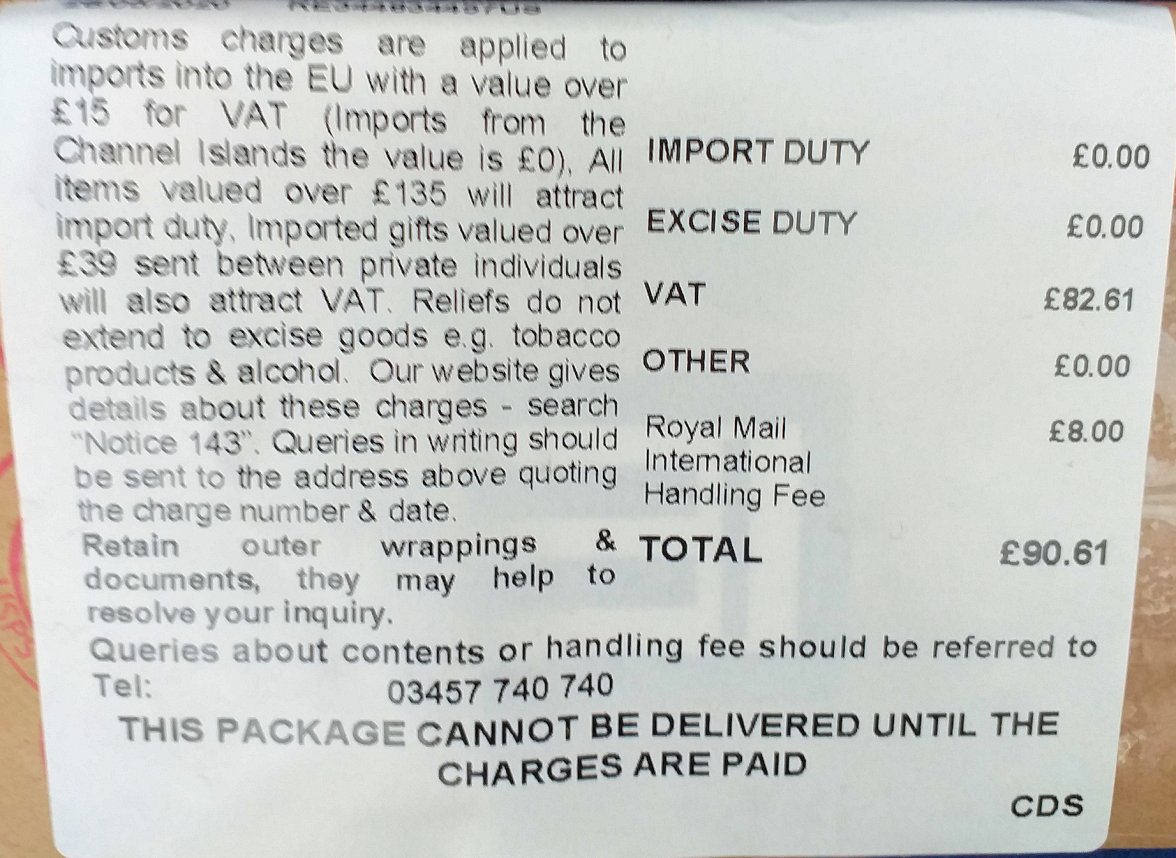

Import duty cost from US to UK

Spruce

··Sunburst dial fanCan it be shipped as watch parts and incur a lower duty ?

ChrisN

·"How do you go about claiming a refund on all these charges if the goods are returned for refund in full?" I don't have any direct experience but I'll bet it isn't easy.

I often receive watches from abroad and always ask my customers to declare the full value but mark as "repair and return" because that's what will happen. Occasionally, customs charge me duty to receive the watch, which is obviously annoying. When I return the watch, I send the import and export declarations to customs and they immediately refund my payment (the VAT part, the small costs on top are impossible to recover). In my opinion, it is easy. Nobody at customs has any great gain from the VAT, they are just following the rules.

Can it be shipped as watch parts and incur a lower duty ?

Why wouldn’t you want to pay full duty?

You just have to bear in mind that if you're buying from outside of EEUU (for a few months more, at least) then allow about 25% on top of the purchase price. After January 2021, the rules may change...

Cheers, Chris

tikkathree

·P pongsteris there no tax free limit in UK? Here it’s about USD180. So anything below gets in free of customs duty and VAT.

"Things getting tougher" it has been suggested to me miight look a bit like tit for tat in light of POTUS' aggressive stance on imports into the US?

TimeODanaos

·Once again I see how stupid the barriers to international trade. They are but stumbling blocks before our welfare! GBP 500 for a purchase ofUSD 1500?? Let's just hope that it's less as some suggested above but still 25% or more of a total USD1500 purchase is still big bucks!

Yes, from an Economics 101 standpoint it is utterly indefensible. I speak with incredulity having fallen into the de minimis trap over a standard-issue leather strap! Most Brits appear not to mind though, as they voted a couple of years back for the same treatment to be applied to European imports too.

Never tried the US to UK option but I was thinking about doing it once I'll be back to London. But considering all above, I guess I will keep sticking the "import via a visiting friend" option 😀

Caution - a similar remark got a near-identical thread mod-locked a few days ago.

For the avoidance of doubt, I always urge compliance with all applicable law. But if I want to opine on its absurdities, I will.

Scarecrow Boat

··Burt Macklin, FBICaution - a similar remark got a near-identical thread mod-locked a few days ago.

For the avoidance of doubt, I always urge compliance with all applicable law. But if I want to opine on its absurdities, I will.

gemini4

··Hoarder Of Speed et aliaCan you claim an duty exemption under the Lend Lease Program?😁

Croc

·There are a couple of websites that allow you to calculate for free, have used this one in the past https://www.simplyduty.com/import-calculator/ allows you 5 free calculations per day. In addition will normally have a handling fee from courier to handle the customs clearance on your behalf, charges should be listed on their websites, but normally need to search for them in their fee schedules

Similar threads

- Posts

- 23

- Views

- 841

- Posts

- 21

- Views

- 8K