Gamestop frenzy

Evitzee

·I got this weird feeling we are approaching that time, but I think I’ve said that the last ten years

Archer

··Omega Qualified WatchmakerThe Fed will keep printing to make the party go on. Everytime they indicate they may stop printing Wall Street throws a fit and the spigot is turned back on. It will certainly continue under President 'Executive Order' Biden.

Trump issued 220 over his term...we'll see how that compares down the road with Biden I guess.

Evitzee

·Trump issued 220 over his term...we'll see how that compares down the road with Biden I guess.

Tony C.

··Ωf Jury memberEvitzee

·You should really look at the history of executive orders for some perspective on the numbers...

The Father

·One thing that annoys me is all other market news is being drowned out by GameStop. Apple takes in 111 billion in revenue, Microsoft smashes it with the cloud again but nope, all GameStop all the time. It’s fun to watch but I will be glad when it’s over.

Apple has record sales and goes down almost $10

I have to believe Apple and other getting reemed is the big boy selling to cover losses in the shorts they have incurred

Walrus

·Apple has record sales and goes down almost $10

I have to believe Apple and other getting reemed is the big boy selling to cover losses in the shorts they have incurred

STANDY

··schizophrenic pizza orderer and watch collectorWalrus

·Well I was just looking at wsb. Some dental student used 46k of his student loan to dump into gme on Friday.

ya I got a link of a fund ticker “AG” is on the list of Reddit attacks. I hold the metal as well (not tons) another interesting one to watch. By the way the “AG” ticker could be a company I’ve been getting so much stuff I can’t keep up. I’m off tomorrow as well may adjust a few things see what the premarket looks like.

*sorry two replies here the one about the dental student I meant to delete but I will leave it for good measure, that’s wsb mentality

*sorry two replies here the one about the dental student I meant to delete but I will leave it for good measure, that’s wsb mentality

Observer

·Well I was just looking at wsb. Some dental student used 46k of his student loan to dump into gme on Friday.

ya I got a link of a fund ticker “AG” is on the list of Reddit attacks. I hold the metal as well (not tons) another interesting one to watch. By the way the “AG” ticker could be a company I’ve been getting so much stuff I can’t keep up. I’m off tomorrow as well may adjust a few things see what the premarket looks like.

*sorry two replies here the one about the dental student I meant to delete but I will leave it for good measure, that’s wsb mentality

Kronos Infinity

·To the moon!

Foo2rama

··Nowhere near as grumpy as he used to be...Yep - seems the "presidential" thing to do in a crisis....wasn't Bush doing something similar when 9/11 was occuring?

Vercingetorix

··Spam RiskInstead of silver, these guys should have picked lithium, cobalt, nickel and manganese. Put the hurt on Elon.

gbesq

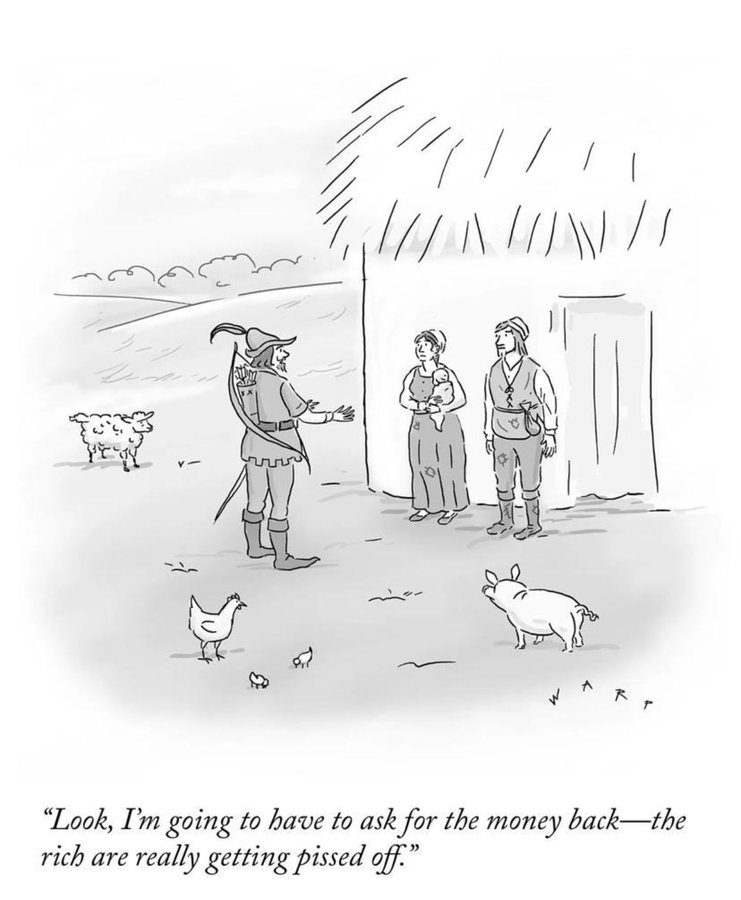

·There is investing and there is gambling. There's a difference. And this is gambling. There will be a few big winners and a lot of losers.

STANDY

··schizophrenic pizza orderer and watch collectorThere is investing and there is gambling. There's a difference. And this is gambling. There will be a few big winners and a lot of losers.

Is this above comment for what is going on ?? or for the Stock Market in general ??

I ask because the stock market is actually a gamble on investment in its true form that results in a few big winners and a lot of losers very regularly 😗

gbesq

·Is this above comment for what is going on ?? or for the Stock Market in general ??

I ask because the stock market is actually a gamble on investment in its true form that results in a few big winners and a lot of losers very regularly 😗

Similar threads

- Posts

- 2

- Views

- 265

Jaeger-LeCoultre Gay Frères E855/E857 Steel Bracelet NOS

Location: CA

TFA

FS

apsm100

Watch Parts and Accessories For Sale

$2500CAD

- Posts

- 4

- Views

- 316