Doc Savage

·Either one believes in the further adoption of Bitcoin and ethereum along with some other cryptos or one doesn’t. It is always unfortunate for those who bought at an ATH and suffer a 50% drop but there are many who bought, well even a year ago and are up substantially. The FOMO has certainly died down but as one looks at crypto performance it helps to zoom out to get the full picture. Bitcoin has been declared dead 130 times now. The things that are possible with ethereum are quite amazing. I like to hear those who think it’s a scam or pyramid Scheme etc, it’s good to look at all sides of everything. I think around here there is more anti Bitcoin/crypto sentiment which is fine. As far as NFT’s go it is not out of the realm of possibility stocks will be NFT’s or traded on ethereum (over simplified explanation) block chain technology was used in some of the programs that handled vaccination appointments. IBM has been building on it, medical records the technology behind Bitcoin has already done quite a bit to help man kind. And it was given free and open source to the world, that part of it will always amaze me. I’m fine with people not liking it, I don’t like broccoli that much but I don’t tell people it’s bad. I eat it cause they say it’s healthy and my wife likes it. Now broccoli rabe, that’s pretty darn good.

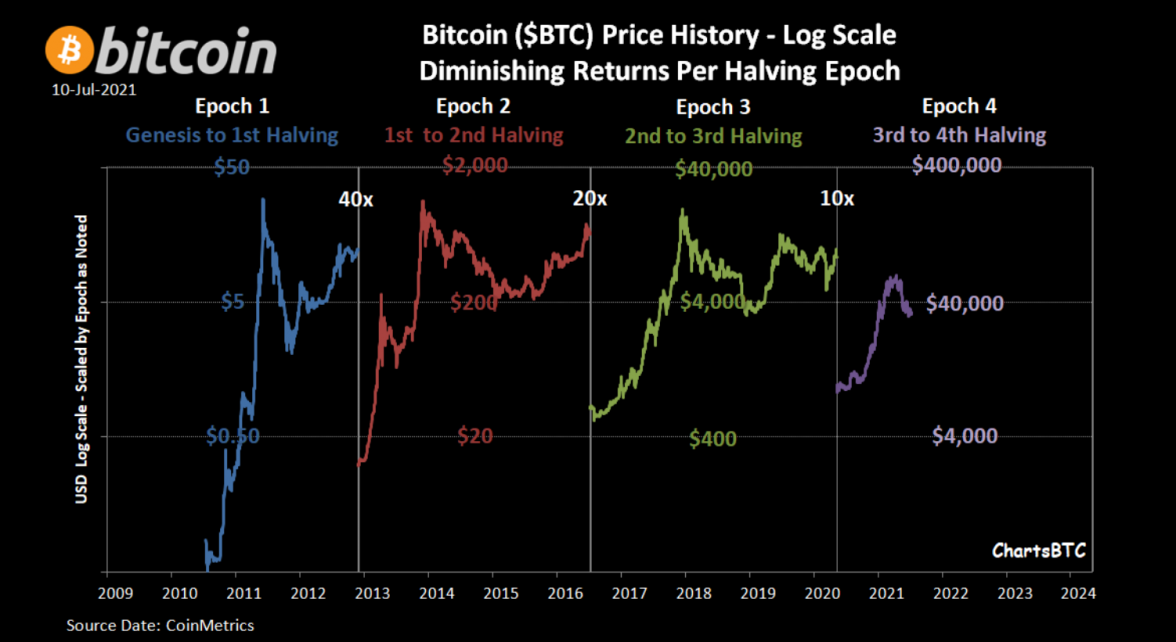

The more important question is where price goes from here. BTC halves every 4 years, and price action during each 4 year period follows what has been a fairly predictable pattern. The question is this: where are we in our curent pattern? Have we topped out, or do we have another run up to new highs before we spend 2 years pulling back and consolidating? I'm not sure.

The chart shows price pattern between halvings.