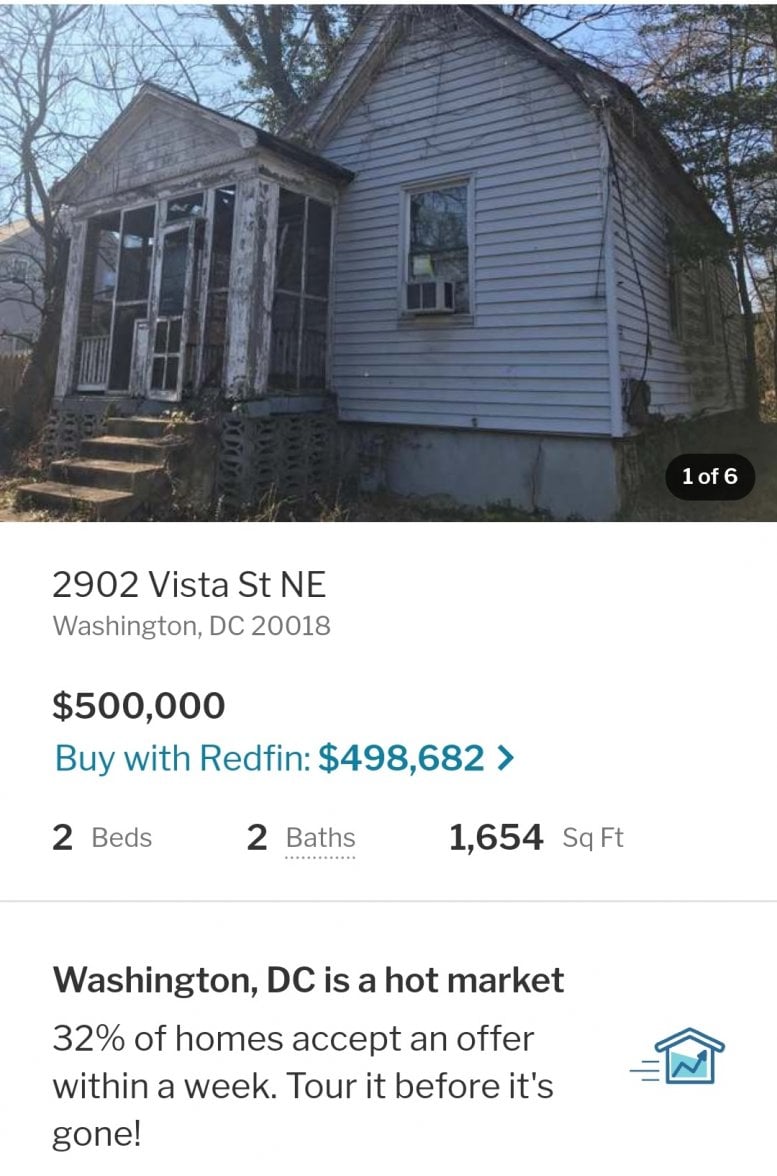

Which of these two would you choose?

vintage hab

·Depends on condition, condition, condition 😉

Charlemagne1333

·The house.

But only if it comes with box and papers…

But only if it comes with box and papers…

BeauW

·Pretty crazy when you put it into visual perspective like that!!

If I had that kind of money burning a hole in my pocket I'd go with the watch. Easier to clean, lower cost of ownership, and mobile!

If I had that kind of money burning a hole in my pocket I'd go with the watch. Easier to clean, lower cost of ownership, and mobile!

MTROIS

·Depends on condition, condition, condition 😉

- Posts

- 323

- Likes

- 225

myatt

·I'd get the Rolex; no property taxes, no maintenance and much higher appreciation potential in that condition - with a potential for a private overseas deal to boot!

- Posts

- 323

- Likes

- 225

myatt

·eugeneandresson

·Definitely the house…the watch looks like a Freese101…much better watch…much cheaper too…

blufinz52

··Hears dead people, not watch rotors.I'd get the house and invite 25 of my closest OF friends for a G2G!

TheGreekPhysique

·Which one is UNTOUCHED?

flw

··history nerdThe house. The inside of a watch case, even a Rolex dive watch, is a bit cramped.