Bernhard J

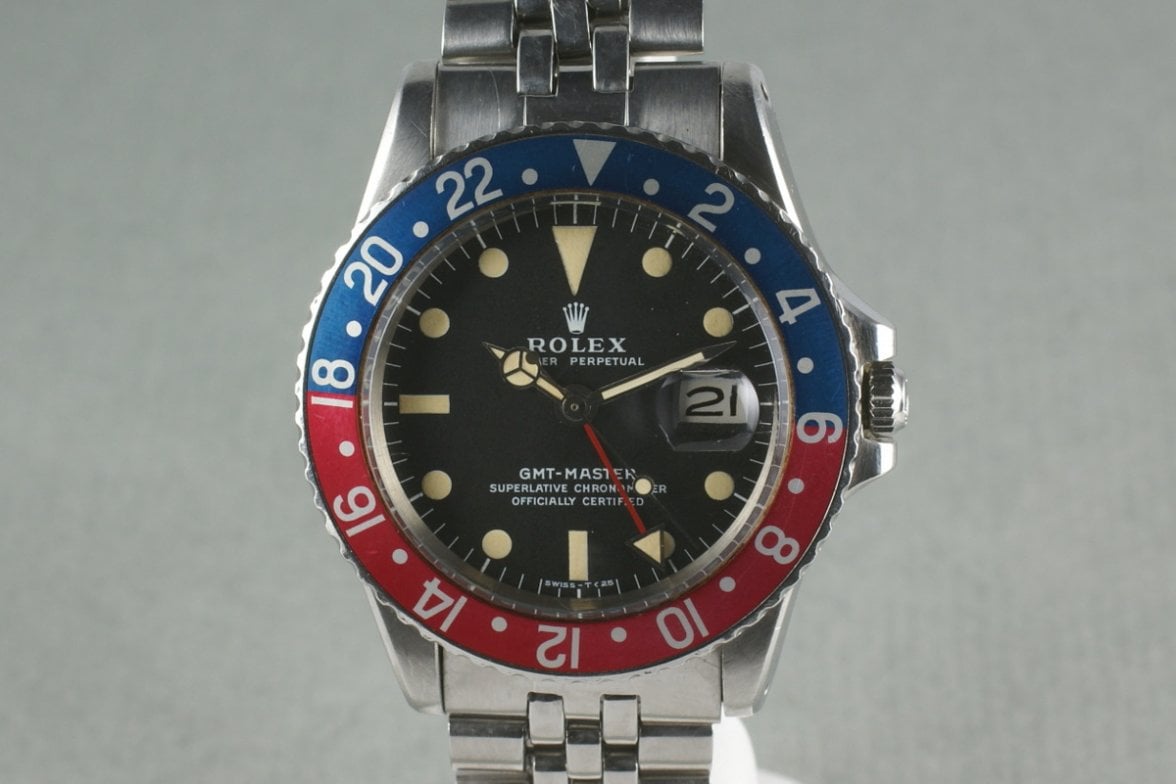

·Just recently I sold a Rolex 16710 for triple of that what it had cost me 20 years ago (sold outside OF). Sounds good, eh? Is about 5,5% per year, which still sounds quite OK. That is significantly better than a standard savings book. But compared with the DAX (German stock market) this is rather poor, because the Dax had made about 7% per year in the same period.

Well, the main difference is the joy in having and wearing this watch over the two decades. Stocks are imo no real world fun, in contrast.

To summarize, collecting wrist watches is no really brilliant long term investment. Even if we collectors like to pretend otherwise 🙄. Money can only be made by (successfully!) flipping wrist watches in short terms.

I do not want to think about pocket watches in this context, I seriously need to ignore that these are really very bad "business", just as well as clocks 😲😁

Cheers, Bernhard

Well, the main difference is the joy in having and wearing this watch over the two decades. Stocks are imo no real world fun, in contrast.

To summarize, collecting wrist watches is no really brilliant long term investment. Even if we collectors like to pretend otherwise 🙄. Money can only be made by (successfully!) flipping wrist watches in short terms.

I do not want to think about pocket watches in this context, I seriously need to ignore that these are really very bad "business", just as well as clocks 😲😁

Cheers, Bernhard