2998’s have lost all the speculative interest in they commanded three years ago, when profit motivated buyers bought watches with issues at what they thought were bargain prices, hoping to sell to “Greater Fools”.

It’s much easier to value a $50,000 example than a $20,000 one. The 50k one is near perfect, correct, indisputably original, and attractive. Anyone with a brain and a little due diligence should be able to do that. The 10-20k example will have issues, that you have to find a buyer willing to accept those imperfections, and each 10-20k watch will be different. Everyone knows what a 50k watch ought to look like, making accurate judgements on the lesser watch is much harder.

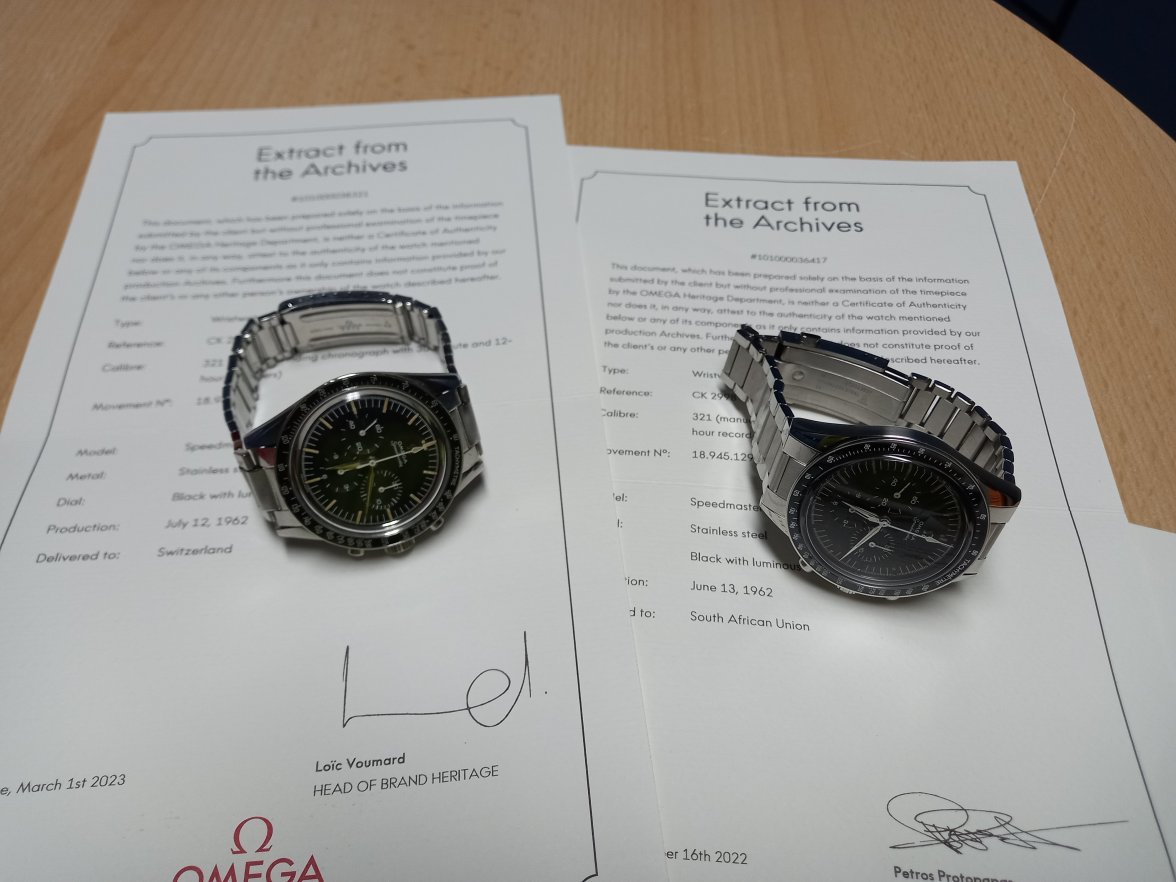

This watch is down in the $10-$20,000 range in today’s market. It is possibly worth more depending on the dial surface condition which I can’t see from the photographs. But really I think the markers hold it back,

The bracelet and end links on this watch used to sell for a very large amount of money, I have seen this combination change hands for $10,000, but I don’t think that is true today. In fact, I think it’s possibly worth less than half that, but I don’t know since the market is so thin that I haven’t seen them sell recently.

One of the comments I often get when I give these lower values is “well I can’t find anything for that price - will you sell it to me?”. Well of course not. just because I think something isn’t worth very much doesn’t mean I want to sell something similar for that amount.

Markets as thin as the Speedmaster market are extremely difficult to work in. Especially the early speedmasters like 2998’s, and 2915’s. If you go looking for something, you will be charged a full price, but if you’re patient and wait, things can come along at the right price - or not. What happened over last six years was that various buyers became overexcited about Speedmaster‘s monetary potential and competed for the rare things. As it turned out, I think potential market makers overestimated the size of the Speedmaster market, and I think there are a lot of 2998s sitting in amateur dealers stock, all waiting to try and sell, if the market turns in their favour. (Check windows in Burlington Arcade).

The thing many people have overlooked, is attraction. Just because a 2998 ticks all the boxes doesn’t mean it is valuable, or desirable. Sometimes a watch’s attraction is the fact it is cheap.

A fun thing to do in terms of valuation is this. Look at the OP watch. Three years ago it might have been offered for $30,000. It might not have sold, but I remember similar being offered. I think, three years ago, it would have sold for 20.

This is how I come to my own value:

how much would the price be for me to have to buy it? Start at $5,000. Yes, I have to buy it at 5,000.

now creep up, 6? Yes, 7, yes. 10? Ooooo. Not really. Depends how i feel. 12? Definitely not. Why? It’s not attractive to go higher today.

For other people their numbers will be different, maybe higher, maybe much higher. Some might not wobble till 15,000.

If I want to sell a watch, I have always thought it should be around 10% less than market to sell. If I offer it 10% over market it won’t sell. The real nightmare for a seller is to “chase the market downward” offering his watch at just over market, then adjusting it downward over time, but always to just over market so it never actually sells.

what do I think this is worth?

12,000

what is it to replace? 22,000, because you would be forced to go looking.