Are members invested in Bitcoin/crypto?

- Posts

- 333

- Likes

- 328

Shay

·Bad experience! I am from the UK I put some money in Bitcoins via a website and I think it was Coinbase. When I invested the money I paid via my UK bank card. After a few months I sold the coins and wanted to retrieve my money, but the broker said they cannot send money to a UK bank account. What was surprising is that when I paid it was from a UK bank account. I started to research and look at potential options and there was none. In the end I had to buy bitcoins again and offer it to a charity.

The moral of the story is that bitcoin is an unregulated product and the intermediaries are free to do what they want and their is no protection for the buyer.

The moral of the story is that bitcoin is an unregulated product and the intermediaries are free to do what they want and their is no protection for the buyer.

Out of curiosity, what is the forums view on BTC?

As a long term holder, the past weeks were quite exciting.

I noticed that the acceptance of BTC in watch trades is still very low, basically 0 and people tend to have negative associations. What is your experience?[/QUOTE

redzer007

·Bad experience! I am from the UK I put some money in Bitcoins via a website and I think it was Coinbase. When I invested the money I paid via my UK bank card. After a few months I sold the coins and wanted to retrieve my money, but the broker said they cannot send money to a UK bank account. What was surprising is that when I paid it was from a UK bank account. I started to research and look at potential options and there was none. In the end I had to buy bitcoins again and offer it to a charity.

The moral of the story is that bitcoin is an unregulated product and the intermediaries are free to do what they want and their is no protection for the buyer.

Why not just move your coin from coinbase to another exchange that.would allow uk bank accounts. Coin is mobile across exchanges.

My guess is within 6 months one or more of the major WW banks will allow BTC transactions. (Note I'm not including the likes of Revolut as that is not traded on exchanges and cannot be moved out of Revolut)

Walrus

·Bad experience! I am from the UK I put some money in Bitcoins via a website and I think it was Coinbase. When I invested the money I paid via my UK bank card. After a few months I sold the coins and wanted to retrieve my money, but the broker said they cannot send money to a UK bank account. What was surprising is that when I paid it was from a UK bank account. I started to research and look at potential options and there was none. In the end I had to buy bitcoins again and offer it to a charity.

The moral of the story is that bitcoin is an unregulated product and the intermediaries are free to do what they want and their is no protection for the buyer.

YY77

·So here's the problem I have with bitcoin, how long are you going to sit on it. When do you decide it's time to sell given the fact it could be half the value in 6 months time or doubled in 3 months time.

Is it really money you have if you're afraid to cash in 30k and keep sitting on it expecting it will go to 50k.

Is it really money you have if you're afraid to cash in 30k and keep sitting on it expecting it will go to 50k.

321Only

·So here's the problem I have with bitcoin, how long are you going to sit on it. When do you decide it's time to sell given the fact it could be half the value in 6 months time or doubled in 3 months time.

Is it really money you have if you're afraid to cash in 30k and keep sitting on it expecting it will go to 50k.

I guess finding an exit point is required for every investment and not specific to Bitcoin.

But I understand that it’s not easy to predict where the price is going especially with all the nonsense spread across the internet and media.

The stock to flow model is widely supported within the community of Bitcoin adopters (aka. Holders). There is a live chart available here:

https://digitalik.net/btc/#

The original article on medium is worth reading as well:

https://link.medium.com/so5wjkC3Acb

Observer

·So here's the problem I have with bitcoin, how long are you going to sit on it. When do you decide it's time to sell given the fact it could be half the value in 6 months time or doubled in 3 months time.

Is it really money you have if you're afraid to cash in 30k and keep sitting on it expecting it will go to 50k.

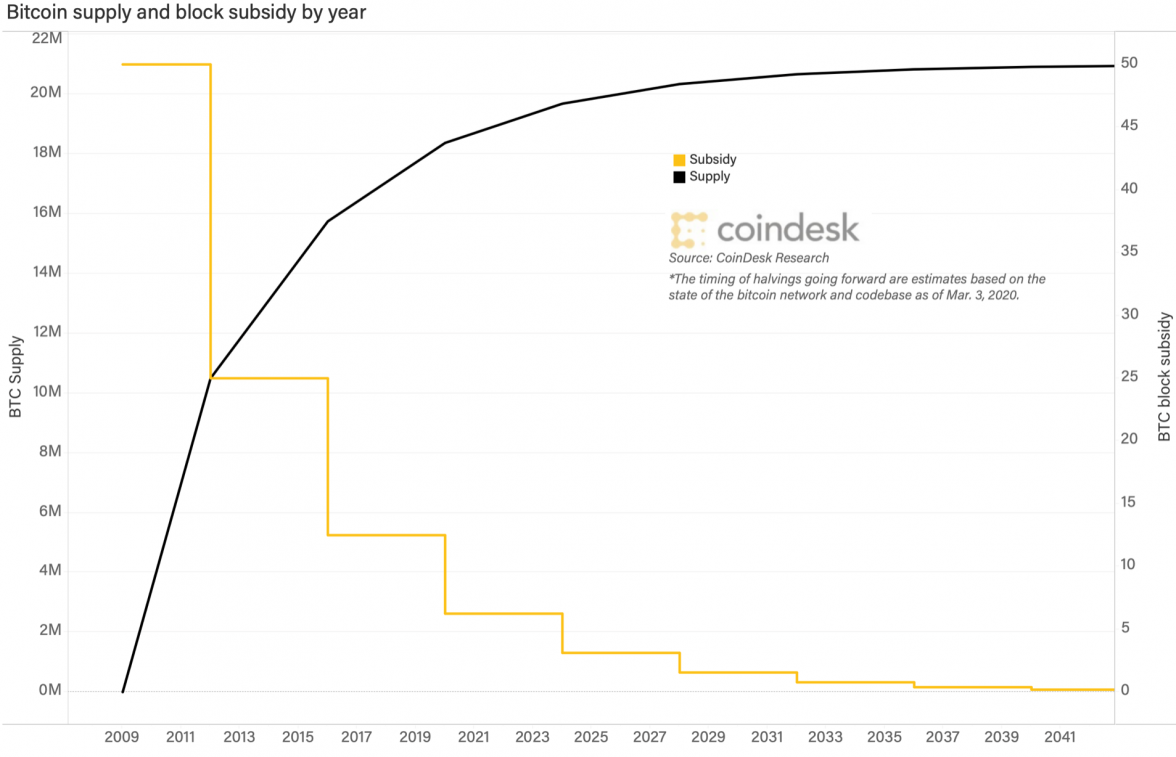

Right now there are many corporations, hedge funds, ETFs, and family offices, each with billions of dollars of assets under management, piling into bitcoin. Retail buyers are just a drop in the bucket now. Even some central banks are buying bitcoin to diversify their reserves. There is a maximum supply of 21 million bitcoin, and several million of those are already gone forever. It's supply and demand, and the nature of the blockchain makes it easy to see that most bitcoin changing hands is being removed from exchanges to be held long term. If you owned a single bitcoin, that would put you in a fairly exclusive financial group.

- Posts

- 333

- Likes

- 328

Shay

·At the time I was not aware I could transfer the Bitcoin. Maybe a bit naive from me!

QUOTE="Shay, post: 1679882, member: 46609"][/QUOTE]

QUOTE="Shay, post: 1679882, member: 46609"][/QUOTE]

Why not just move your coin from coinbase to another exchange that.would allow uk bank accounts. Coin is mobile across exchanges.

My guess is within 6 months one or more of the major WW banks will allow BTC transactions. (Note I'm not including the likes of Revolut as that is not traded on exchanges and cannot be moved out of Revolut)

Observer

·Up about 25% since this thread last saw action.

321Only

·Let’s see where the bull runs finds a peak. Expect some heavy volatility and buy the dips!

Walrus

·Could go down just as quickly. I was pleased to see etherium get some traction again. Back in the day I thought that was going to be “the thing” I was very impressed with the tech and capability behind it. Granted everything is being carried by bitcoin at the moment but I will take it. It is funny to watch.

connieseamaster

·I think the recent movement is related to the FTC clarifying it's regulations regarding US banks using blockchain based transactions. Of course, I don't think that will mean big banks looking to hold more crypto (though many do have at least a bit in their portfolio), but you will see more investment into the blockchain technology space.

The Father

·This is damn bullshit.

Like TELSA, I have not invested in BITCOIN because when I do the thing will crash.

I should just go out and buy TESLA and BITCOIN and watch it tank, but I do not want to put a Voodoo hex on all that have bought it.

Like TELSA, I have not invested in BITCOIN because when I do the thing will crash.

I should just go out and buy TESLA and BITCOIN and watch it tank, but I do not want to put a Voodoo hex on all that have bought it.

Dsloan

·This is damn bullshit.

Like TELSA, I have not invested in BITCOIN because when I do the thing will crash.

I should just go out and buy TESLA and BITCOIN and watch it tank, but I do not want to put a Voodoo hex on all that have bought it.

Please let us know first so I can buy puts!

worldwidewes

·People that "invest" in Bitcoin aren't investors...they're speculators. You can't invest in something that doesn't produce anything of value. You can invest in a company or a farm, but not something like Bitcoin.

321Only

·Crypto is a high risk asset. Will there be 30% gains and drops? yes! will it crash? probably, history of 2017, 2013 and 2011 will likely repeat. But zoom out and look at the ten year performance before judging. I personally believe that the economic environment could not be any better.

Bitcoin = Code, deflationary behavior

USD = Paper, inflationary behavior

It sounds provocative but 2020 could bring one to the conclusion that USD might be the bubble.

Bitcoin = Code, deflationary behavior

USD = Paper, inflationary behavior

It sounds provocative but 2020 could bring one to the conclusion that USD might be the bubble.

Edited:

NGO1

·People that "invest" in Bitcoin aren't investors...they're speculators. You can't invest in something that doesn't produce anything of value. You can invest in a company or a farm, but not something like Bitcoin.

Every sentence of your post is a fallacy.

Your definition of “invest” and “value” are vastly outdated.

2021 is officially a digital world, whether we like it or not.

Ignoring digital and crypto currency will quickly leave you behind.

Look at the data.

Observer

·People that "invest" in Bitcoin aren't investors...they're speculators. You can't invest in something that doesn't produce anything of value. You can invest in a company or a farm, but not something like Bitcoin.

On the other hand, I really am speculating, and the returns are amazing.

Wryfox

·The ultimate Fiat money, and for that matter, so is gold. Nearly 90% goes to jewelry. Humans like pretty shiny things.

I invest in things that have total utility worth. Like toilet paper.....

I invest in things that have total utility worth. Like toilet paper.....