OK, let’s drift further away from the original subject…

If public funds are used to bailout banks, then the pubic needs to have a stake in the ownership of the bank in return and the incompetent management to be held responsible for their poor performance …..no more free money to these dickheads!

First, understand that those who had equity in SVB and the other banks involved here were totally wiped out. I think that the US and state governments need to take a hard look at bonus money paid to officers at these banks just prior to this crisis. If laws were broken, then lock them up or claw it back.

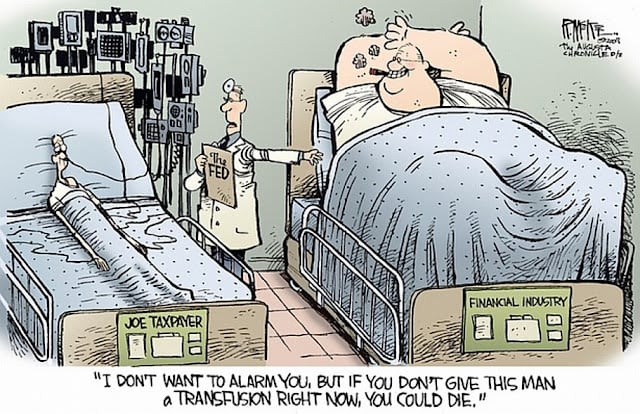

The money used to “bail-out” these banks essentially paid depositors, most of whom were neither involved in the bad decisions made by management nor stockholders. They were simply business customers who deposited receipts, paid expenses and ran their payroll accounts through the banks.

The current $250K FDIC insurance limitation was set in 2006 and is not indexed to inflation. It was intended to protect individuals and not necessarily businesses. $250K doesn’t begin to approach the amount of a bi-weekly or monthly payroll for a business of any size. Since almost all payrolls are done these days by bank transfers, funds have to be on deposit somewhere.

If the US Government did not step in as a secondary insurer, it is likely that small to medium sized businesses all across the country were not going to meet their payroll obligations to their employees and would start closing their doors, throwing thousands of innocent people (the vast majority of whom were not SVB customers) out of work.

This is a situation brought on by a number of factors, most of which were caused by bad management of these banks, but some of which were made worse than necessary by bad decisions of the FED and the US Government as led by both parties.

The path chosen was likely the least worst alternative. This is a classic example of a chain only being as strong as its weakest link.

gatorcpa